Nvidia just reported record quarterly revenue of $3.21 billion for the three-month period that ended April 29. That is up 66 percent year-over-year from $1.94 billion. Increased demand for GPU-based artificial intelligence is one of the key factors driving Nvidia’s growth, but the company also saw huge jumps in spending in its gaming category and from cryptocurrency miners.

“We had a strong quarter with growth across every platform,” Nvidia chief executive officer Jensen Huang said in a statement. “Our datacenter business achieved another record and gaming remained strong.”

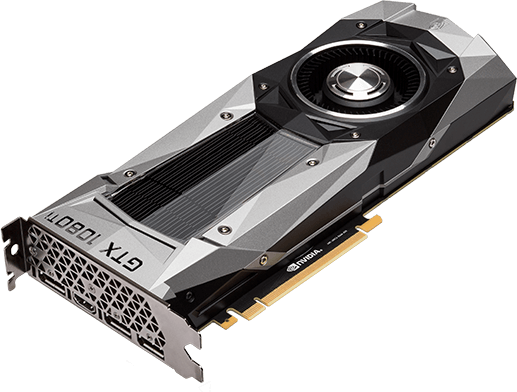

Gaming remains Nvidia’s biggest market, by a wide margin. This space, which includes GeForce GTX GPUs and the Tegra chips that power the Nintendo Switch, generated $1.72 billion alone. That was up 68 percent year-over-year from $1.03 billion.

“Gaming GPU growth was fueled by demand for the best experience while playing esports, momentum of the battle royale genre, and triple-A cinematic games,” reads Nvidia’s earnings report. “Tegra Processor business revenue — which includes SOC modules for the Nintendo Switch gaming console — was $442 million, up 33 percent from a year ago and down 2 percent sequentially.”

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

While gaming GPUs are selling faster for Nvidia, its fastest-growing market is the datacenter space. That is up 71 percent year-over-year to a record $701 million. That’s where the company’s TensorRT 4 and DGX-2, hardware and software work together to unlock the power of deep-learning algorithms. The GPUs that Nvidia makes for its datacenter clients are significantly more expensive than consumer models. The DGX-2 sells for $400,000, for example. That means Nvidia only needs to sell a handful to a few A.I. companies to make a huge dent in its earnings.

Finally, cryptocurrency was still a major factor for Nvidia. People use its GPUs to process the blockchain algorithm for digital currencies like Ethereum. This helps to maintain the integrity of the data on the blockchain (in this case, who owns how many digital coins) in exchange for new digital coins. The crypto craze has slowed down, which has helped supply and demand stabilize for the first time in a year. But during its Q1, Nvidia was still able to bring in $289 million from mining-related activity.