Tilting Point has had a good run of success as an operator of free-to-play mobile games that are already live on the market. Tilting Point takes those games and uses its expertise to acquire users efficiently with big marketing campaigns.

It has helped some major mobile games get traction by giving them the mobile marketing campaigns they need to stand out in the crowd. For instance, it pumped $18 million into marketing for Food Truck Chef and boosted its revenue by three-fold and increased organic installations by ten times. It took Disruptor Beam’s Star Trek: Timelines mobile game and helped add five million downloads since 2016, and now the game is a top-grossing title in 80 countries. And it helped TerraGenesis get a 300 percent return on installs, a ten times increase in revenue, and a five-fold improvement in profits.

Samir El Agili took over as president of Tilting Point about a year-and-a-half ago, and the company saw its revenue shoot from $9.5 million in 2017 to more than $45 million in 2018. He grew the company’s staff from 14 to 76 employees, mostly focused on data analysis, user acquisition, and live operations. Its user acquisition budget grew from $12 million to $132 million.

“We’ve changed who we are completely,” Agili said in our interview.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Here’s an edited transcript of our interview.

Above: Samir El Agili is president of Tilting Point.

Samir El Agili: I’ve been at Tilting Point for three-and-a-half years. I’ve been running the company for about a-year-and-a-half. The company is very different from it was in the past. We had tremendous success over the past year. The primary number we like to use to show that is we’ve had close to 500 percent growth in gross revenue. We went from being a $9.5 million company to a $45 million company in gross revenue last year. We’ve changed who we are completely.

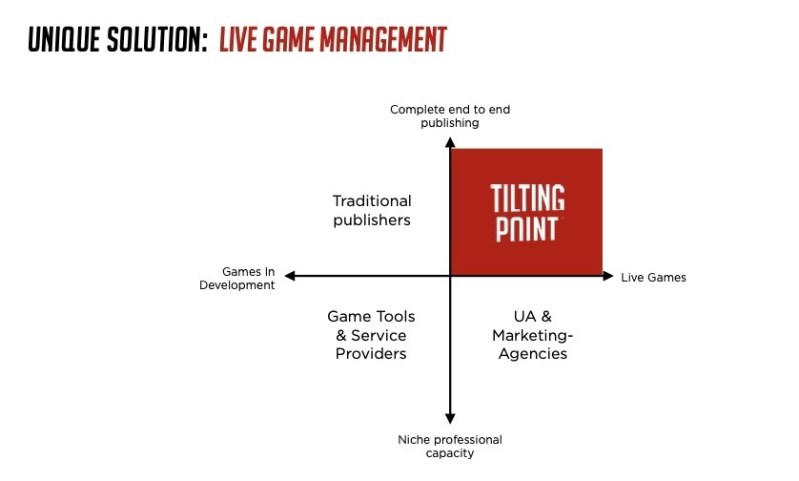

What differentiates us — we’re a free-to-play mobile game publisher, but we focus on games that are already live on the market. That makes us unique, because what we don’t do anymore is the traditional publishing aspect of taking a game from the middle of production to market. That was the old model Tilting Point had. What’s been extremely successful for the past three years is building technology and expertise around how to take existing games that have been on the market for a certain amount of time and scaling them up to success.

Also, not only is the business focused on scaling, but there’s a UA fund. We invest in these games. It’s a different relationship. Our approach is to say that we’re going to offer developers that have games on the market a unique and impressive solution. We’re going to do the user acquisition for them with our own proprietary technology and our expertise that we have in-house. We use our own funding. We take the risk by investing our own money, which can be millions of dollars on a monthly basis.

That’s a good way for us to differentiate ourselves. Once we start working on a game, we know we’ll be able to do it profitably. We’re very much aligned with the developer’s objective of being able to scale their game profitably, which is not always the case. There are lots of agencies out there, UA agencies and other types of publishers, that are not incentivized to scale a game profitably. We are. That’s unique.

Above: Tilting Point is helping Star Trek Timelines grow.

GamesBeat: We did a story on Disruptor Beam recently. Is that a good example of the way you work now?

El Agili: Absolutely. That’s a great example. Disruptor Beam is a good case of a game that’s a top-grossing game, with a developer partner that was doing publishing and user acquisition themselves. We came in and helped them with funding initially, funding for user acquisition, and now we’ve fully taken over the user acquisition for their game. We’re scaling it up even more, even after it’s been on the market for more than four years.

We have other examples as well. We have games like Food Truck Chef. We’ve committed more than $18 million to that game over the next two years for user acquisition. We’ve been able to multiply organic installs by 10. We’ve multiplied revenue by three already. Another good example is TerraGenesis, which is more of an indie game. We used to work more with indie companies. TerraGenesis is a fantastic indie game that came to see us about a year ago. We’ve been able to multiply their revenue by 10 and increase their profits 5X. That’s the type of thing we do.

Beyond just doing user acquisition for them, we also use our technology to create our own advertising. We create ads ourselves, up to eight ads our week — three video ads and five static ads. The market is very saturated. We’re also in some cases going to help them improve a game on the monetization side.

GamesBeat: How do you put that into the context of things like Google’s universal app campaigns? Or in the case of Facebook, it has gotten so good at what they do that they don’t leave much room for third-party ad tech companies to do much anymore.

El Agili: The way we address this is, first of all, we’re building our own technology for user acquisition. We’re always trying to understand, very carefully, what Facebook and Google are doing with their algorithms and how they change their algorithms over time. Even though they’re getting better at it, it’s still very difficult, because of the number of players out there in games, to be able to compete intelligently and be making the right decisions when you’re doing user acquisition.

One good example is the ads themselves. Google and Facebook are not helping you build ads today. We’re investing a lot on that at Tilting Point, building content and making sure that, for one game after one year, you can be talking about having 100 or more different ads running at the same time. These ads are very targeted at the right audience to maximize return on investment. For us it’s fantastic that Google and Facebook are improving their algorithms, because they’re helping us find the best users for our games. That needs to be matched with fantastic creative.

The second piece is that we’re also working with other ad networks out there, including things like IronSource and AppLovin and many others. These ad networks are using proprietary machine learning for user acquisition, tools that we’re constantly changing on a daily basis, constantly improving to adapt to different channels that are usually less targeted than Facebook and Google. Facebook and Google have their own algorithms and are very targeted. These others are not as targeted. Our tool is enhancing the power of these other ad networks.

Above: Tilting Point’s strategy

GamesBeat: Is there still a lot that can be done here “manually,” so to speak?

El Agili: Absolutely. What happens with the Google and Facebook platforms is you define a set of parameters in their algorithm and start finding users, but you still have to define those parameters. You still have to do that very well. That’s not an easy path to master, even for large developer-publishers.

We opened an office in Barcelona in June. We grew our company from around 53 people to about 76 in 2018, and a big part of that growth was opening that Barcelona office, which is almost solely dedicated to building creative.

GamesBeat: That creative area seems to be a rich vein to mine, how you build creatives and what tools you use to measure effectiveness. It’s not so easily automated.

El Agili: I’d say that building the ads themselves, creating the ads, is the area where there’s the most competition today. There’s going to be even more tomorrow. You have to constantly refresh your ads out there to make them accurate and maximize the return on the number of times people click on an ad.

We’re constantly trying to push the envelope on technology. Because there’s a lack of technology around creative, around automating the building of creatives and maximizing the number you want to build per week, we’re building a lot of tools internally to help us do that. We have a few already. We have a big push on that coming in 2019.

Currently we’re working with 26 games, by the way, ranging from indies to much bigger. We have some exciting new games, triple-A or bigger properties, that are coming in 2019.

GamesBeat: What else is there to the work you do, beyond providing user acquisition funding and expertise? What else is helpful?

El Agili: We have a full set of publishing services at Tilting Point. What we’ve understood, and what makes us a free-to-play publisher that’s adapted well to the market, is that we start with a very simple offering, which is doing user acquisition, the ads themselves, and the funding for that. Progressively we deepen our relationship with our partners if we need to, by providing expertise and product improvements.

We’ve hired and built a team of very strong experts in free-to-play, people who’ve built and operated live services for many successful free-to-play games. We’re also building tools around that aspect. Once we’ve scaled a game like Food Truck Chef successfully and we’re at a point where the developer feels our partnership is going well, we’re usually going to invest more time and effort, assign more people, and start improving the game itself — improving the monetization, helping with systems and features, and helping the other side of the equation scale so lifetime value is higher, and we can continue spending in user acquisition to grow the game even more.

We essentially have a full publishing service that’s dedicated to free-to-play games, but we start our partnerships with UA and funding and creative. Then we evolve progressively through improving the games themselves.

Above: Star Trek: Timelines is a top-grossing game in 80 countries.

GamesBeat: How are you identifying the games that can really benefit from your help, or that could turn into much bigger hits given your user acquisition work?

El Agili: We spend a lot of time with various pieces of insight on the market. We use things like AppAnnie and other services out there. We’ve built some tools on top of AppAnnie to help us find out, based on certain algorithms, the ideal candidates. Because we have so much visibility on the market, we’ll be able to see trends that are interesting to look into.

Let’s focus, for example, on space games, which is the case with TerraGenesis. We see that there’s a trend in that kind of game. It’s driving low cost per install. People are interested in that genre. We’re going to look for games that we believe have the ability to be scaled. Then we’ll reach out to developers based on that. That’s the proactive way.

The other way to do things, and what’s happening more and more, is because we have this $132 million fund out there, which grew from just $12 million a year and a half ago, we’re getting known for being the best in the market for user acquisition, and also being known for taking risks. Developers appreciate that. We have a lot of inbound as well, from developers who are already doing UA and spending money and growing their games. They’re saying, “Hey, can you help us do better? Can you help us spend more?” Every month we evaluate a lot of games. We don’t work with as many of them, but once we do, we ensure that it’s a long-term partnership built around profitable growth.

GamesBeat: Are you able to do a lot of this on your own, or are there some key ad tech partners that you work with as well?

El Agili: We work mostly on our own. Our general philosophy is to work with external partners when we see something in the market that’s good, but when we’re missing something, we’re usually going to build it internally. For example, on the user acquisition technology, we built our own machine learning system two years ago, because we didn’t think there was anything on the market that could give us the edge we needed to be at the forefront of user acquisition. We’re doing it right now on the creative side and the live operations side to monetize games. We’re consistently saying, “If there’s not a tool that exists on the market, let’s build it.

GamesBeat: Who ends up being your competition most of the time?

El Agili: When we started pivoting toward our current model about three years, there was very little competition. Today there’s no pure player like us that’s doing a full publishing service for live games. There are obviously a lot of mobile game publishers in the traditional sense, companies that are going to find a game in development, invest in that development, do marketing, and release it, but there aren’t many companies that are going out and funding games that are already live with user acquisition like we do.

There is one company called Deca Games that does the monetization side of the equation, and we sometimes talk with them. But nobody is really doing exactly what we do.

Above: TerraGenesis has seen a 10X growth in revenue.

GamesBeat: I wrote about some recent arrivals on this front. I don’t know if Network and Asteri are in the same neighborhood as you are.

El Agili: These companies, from what we know of them, and I don’t know them very well — my understanding is that they don’t quite do exactly what we do, which is the funding piece. They might do the user acquisition piece, but I don’t think they do the funding. Also, from what I know, I don’t think they do the monetization and live operations end of the spectrum.

GamesBeat: What about something like Microsoft’s PlayFab? Could that amount to competition?

El Agili: We’ve been working with companies that use PlayFab. For us, I don’t see that as competition so much as — because of the full spectrum of what we offer, especially the funding piece and the risk we’re taking, this is usually not going to be a competitive situation, but more an opportunity to work with partners who also use that. I’m not fully familiar with the integration of PlayFab, but we’ve worked with partners that use it in the past, and those were successful partnerships.

GamesBeat: When you launch something, like when you’re working with Star Trek: Timelines, what are some of the things you do in that process and how they happen? Do you just kick off an ad campaign, or is there something else that happens?

El Agili: When we work with a partner, at a high level there are essentially two cases. There are the games that are currently doing user acquisition successfully and there are the ones that are not. In the case of Disruptor Beam, they were doing user acquisition successfully. We could start looking at what they’d done in terms of user acquisition — the ads they used, how those ads were performing — and see what we could optimize. We were identifying what work we could do at Tilting Point with our technology and expertise to improve that performance, which can range from 20 percent to sometimes 300 percent improvement.

Continuing in the case of Disruptor Beam, the steps began with doing our own forecasting of lifetime value, which is something we’re very strong in. What makes us also pretty unique is we forecast, by ourselves, the lifetime value of users. When you have four years of historical, as in the case of Disruptor Beam, you can look back and see how much players are spending in the game over time, and forecast how much they’ll spend over the next two or three years. Then we’ll build an ad, or multiple ads, and progressively invest more and more with a partner and try to scale up the game as much as we can, profitably.

It’s a little different in the case of a developer that hasn’t done their own user acquisition, obviously. In that case you need to make sure to plug in to things like Facebook Connect. Some might not yet have the proper systems and APIs in their games. Then we can start progressively evaluating. It goes a little slower in those cases.

Above: TerraGenesis

GamesBeat: Singular puts out reports once a year or so concerning return on investment from different ad networks, Facebook and so on. They say the ROI information is hard to do, even when they specialize in it. Would you say that’s a fair statement? You’re able to figure out someone’s lifetime value, but going back and calculating the ROI on going after that kind of person is more complicated. Is that something you also specialize in?

El Agili: Of course, yes. The success of our model and the fact that we’ve grown so much, at its foundation, is based on the fact that we’ve built something based on data, data science, and other pieces as well. But the data science we’ve built, the data and the technology around it, has allowed us to be very accurate in our prediction of return on investment.

Historically we have a prediction accuracy of 97 percent when we look at everything we’ve done in the past. We’ve been only missed projections on three percent. The way we’re able to do that is — our system is live. It turns a campaign on or off within a few hours. Instead of having a person that manually checks every ad and how it’s performing, this is done through a machine learning system. Our system is going to check, for every campaign, how the players you’ve acquired through that campaign are performing in the game. It’ll measure the LTV and decide to reduce or increase the amount we’re spending for that type of user. At a very high frequency and a very high level, it maximizes accuracy.

Our technology is really what gives us the edge on that. The more we work with partners out there, the better we become at predicting LTV. The more visibility you have, the more accurate you can be in terms of return on ad spend.

One thing that also makes us unique is that we approach this as — our initial contact with a developer is very much an open discussion. We’ll sign a very light deal, a very light contract initially, which is very different from a traditional publisher relationship. It lets the developer leave at almost any point. We just say that we’re going to spend a certain amount of money initially and progressively spend more. The developer is very much free to end the partnership if they don’t feel that it’s going well. Our approach is that they’re going to want to continue working with us because, first of all, we’re providing funding, but also because we’re providing a unique service, the best service out there.

Above: Warhammer Chaos & Conquest.

GamesBeat: What are your thoughts on the future of where mobile games are going? Things like increased consolidation and the rising costs of marketing?

El Agili: Of course there’s a lot of consolidation happening in the market. To grow, many companies out there are going after developers and trying to acquire them. Consolidation is a fact and it’s going to continue.

One of the things we’re building here at Tilting Point is empowering smaller companies to be able to compete with the bigger guys. Even if you have the best game on the market and very strong KPIs, if you don’t have the funding or expertise to scale your game, you’re not going to be able to compete. You’ll be acquired, even if you don’t want to. Part of our positioning is to say that together, we’re stronger. Just because you’re an independent developer, that doesn’t mean you can’t have the resources to scale a game as big as the big publishers.

The other interesting angle is the hyper-casual segment. My feeling is that the hyper-casual segment has had tremendous success over the last few years, but it’s going to get more and more difficult for them. The barrier to entry for that type of game is very small. These games are being built in a few days. They’re copied left and right. The battle for these games is really on user acquisition and ad monetization, not the development itself.

These games will gradually become more and more difficult to build. My sense is that hyper-casual games will start having more in-app purchases and subscription systems in them, progressively. This is a place where it might make sense for Tilting Point to get involved in that market, but today we’re not very interested. We’re much more interested in games that have long-tail revenues and players that can play for five years or even more.

GamesBeat: What’s the most recent partnership deal you’ve formed?

El Agili: We’ve announced Star Trek Timelines with Disruptor Beam, and we’re going to announce more plans with Disruptor Beam in the near future. Our most recent signing is with a developer we’re already working with, Hunted Cow, doing a game called Operation: New Earth. Now we’re working on a game called Warhammer: Chaos and Conquest, based on the Games Workshop license. That’s our most recent announcement.