Presented by Wells Fargo

It’s a rare dynamic when two companies can work together to innovate in ways that not only benefit their interests, but also benefit their mutual customers. But when banks and fintech companies decide to collaborate on new ways to share their mutual customers’ data, all three parties come out ahead.

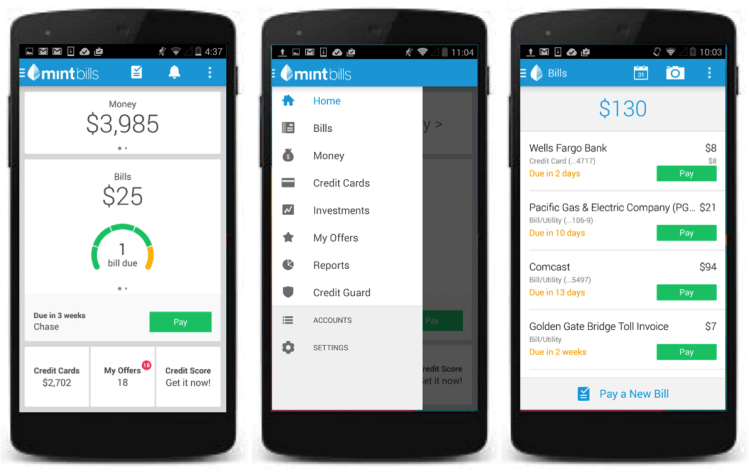

A variety of digital financial management tools exist for both consumers and small business owners. Between the full-service digital experiences that banks and credit unions offer, and third-party tools like Mint, QuickBooks, and Xero, the ability of consumers and businesses to easily manage their finances has significantly improved. All of these new tools and experiences have made it increasingly convenient for customers to track and manage their finances.

Up until last year, when bank customers enrolled in a third-party online accounting or financial management tool, they typically provided that service with the login credentials they use for their financial institutions — the credit union with their checking and savings accounts, their credit card company, and the bank that holds their mortgage. Each time a consumer or business owner logged into that service, it used those credentials to access information from each website, and imported it into the service’s platform. For those with accounts at multiple institutions, these services could make it easier to get a look at their financial picture in one glance.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

While bank customers find these services both convenient and helpful, both banks and fintech companies recognize the desire to innovate beyond this “screen scraping” method of data sharing.

In looking at ways to improve the experience for all parties involved, Wells Fargo identified three key areas where innovation could greatly improve the process:

- Find a way to remove the customer’s login credentials from the data collection and sharing process

- Create a more reliable data-sharing experience. With screen scraping, whenever a web page was updated or changed, the data collection could fail. This creates a frustrated customer for both the bank and the service

- Give customers more visibility and control over what data they share with these services

To find a more reliable method of data sharing that gives the customer more control and transparency, we turned to application programming interface (API) technology developed by Wells Fargo’s new Gateway Channel. Through our API solution, we have tokenized the data request and sharing process.

Through this technology, we can now execute a tokenized “handshake” between our servers and those of our customers’ financial management tool providers. This tokenized transaction removes the login credentials from the process, creates more reliability and predictability in the data sharing, and allows customers to select which account information they share.

Fintech firms have shared our interest in improving this experience for our mutual customers, and both small-business accounting software firm Xero, and Intuit have agreed to transition their Wells Fargo-data sharing process to the new API-driven handshake. Soon, users of Xero’s software, QuickBooks Online, QuickBooks Self-Employed, and Mint, will benefit from our shared desire to improve the reliability and efficiency in the data-sharing process.

These financial management and accounting tools are an incredibly important component to the financial health and success of consumers and small businesses. By working together to improve upon the way we share data with each other, financial institutions and service providers make a more convenient experience for our mutual customers, well over a million of whom are using accounting software or third-party financial management tools, in addition to our digital banking services. More importantly, we’re giving them more control over their own financial information, and ultimately their own financial destiny.

Brett Pitts is Head of Digital for Wells Fargo Virtual Channels

Sponsored posts are content produced by a company that is either paying for the post or has a business relationship with VentureBeat, and they’re always clearly marked. Content produced by our editorial team is never influenced by advertisers or sponsors in any way. For more information, contact sales@venturebeat.com.