The Internet of Things is expected to grow quickly to tens of billions of connected devices, from smart refrigerators to smart showers to smart cruise ships. Pretty soon, it’s going to extend to smart cars, as Intel demonstrated at its recent autonomous cars event in San Jose, Calif.

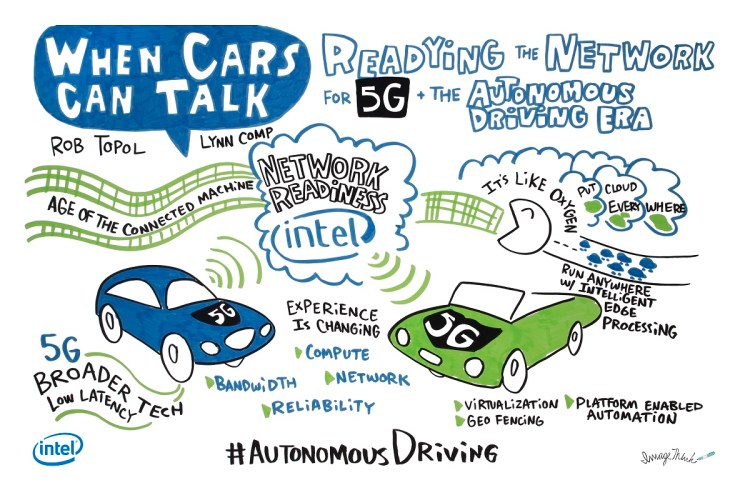

But Intel knows that we’ll have to get data in and out of those cars at rates that are much faster than today’s LTE mobile networks can handle. And that’s why Rob Topol, general manager of Intel’s 5G business and technology, believes that 5G wireless networking will be like the “oxygen” for self-driving cars.

Intel is making 5G modem chips to transfer data at gigabits a second over wireless networks in the future, perhaps as early as 2020. Topol believes this wireless networking will enable self-driving cars to communicate with connected infrastructure. That infrastructure will help the cars process sensor, safety, and other information for the car and return the results quickly to the cars.

“What we were showing with that demonstration is a capability called V-to-X — vehicle to infrastructure, vehicle to pedestrian, or vehicle to vehicle,” Topol said. “You’re utilizing the other objects and using a network to give the car vision beyond things it can’t see through the mechanisms in the car itself — something that’s happening around the corner or further ahead.”

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

We talked about 5G and its connection to autonomous driving in a recent interview. Here’s an edited transcript of our talk.

Above: Rob Topol, general manager of the 5G business at Intel.

VB: Where are we on the timeline for 5G?

Rob Topol: As you’ve seen, there’s been lot of work going on in 5G over about the last year and a half. It started with developing the air interface, how it works between the device and the core access network. It starts with the trial specifications we’ve been doing, where you try out different things like modulation or channel coding, essentially building this new radio.

The timeline is that you do many of those trial specifications over about a year to two years. All that work you do in the field, testing with partners and building a recipe, you take them to the standards bodies and submit them as contributions. Intel and other companies will submit their ideas and say, “This is what we think the standard should be based on.” The voting happens in 3GPP from a cellular standpoint, with the first round later this year. In December, the New Radio, or NR specification, will be set, and the full release for 5G happens in Q3 of 2018.

Once the NR spec is set, that’s when you’ll start to see development around the modems, around the networking equipment to support that. Full release 15 is at greenlight. That’s when you see the Capex orders come in from network operators to the infrastructure companies. Intel puts its chipset designs into production. You start to see some operators roll out networks as early as 2019. You’ll probably see most do them around 2020. Typically, once the full release is done, it’s about 18 months until you start to see the networks deployed in a broader way.

VB: How do you help people get an appreciation for how important this is? What’s at stake? What will people get out of it?

Topol: We focus on the things that 5G is about that 4G was not, if that makes sense. 4G was the era of the smartphone — data proliferation, access to media, mobility in general, with something in your pocket. 5G is an era beyond the smartphone. Over the next five to 10 years, we have billions of connected things coming up all around us. As we make everything from a refrigerator to a car to a home to an enterprise network smarter, the compute that’s happening—more data is sent through a network, whether to help improve the service model or the user experience of those things, or to harvest that data for machine learning and data analytics, any sort of behavior or artificial intelligence work.

We look at 5G as the platform that helps all of those other verticals grow. We see some of the early use case research. We see a lot of promise for 5G in automotive. We see a lot of promise for smart home and enterprise, if you move networks more to a fixed wireless capability. Not just relying on fiber and other LAN connections. We’re also looking at industrial automation. We have a few projects in that space, helping get a lot of that incubation going. What does a connected factory mean? How does it operate? How would a factory benefit in productivity, in the way machines are set up and run and optimized, when the factory is connected? What capability does that bring?

How do we help people with that vision? We show as many of those use cases as early as we can. We go out and showcase with automotive companies, showing them 5G in a car, so they can see the way data comes into the car for the way it functions, for safety, and more important for bandwidth, the way our experience inside the car is going to change when it’s autonomous. When you’re sitting in the back seat of that car, your experience changes. You’re not required to be fully focused on where it’s going and what it’s doing. The bandwidth requirements in the car are going to grow exponentially as our time is freed up inside the vehicle.

We do the same thing in industrial automation. We set up a partnership with GE and Honeywell and Ericsson called the 5G Innovators Initiative. We’re blueprinting what we think the factory of the future could and should look like, how it would operate. We try to give people that vision. We’ll do that for how drones are used. We’ll do it for fixed wireless in home and enterprise. We’ll do it for media and viewing experience. We’re working with media companies to look at the way media is captured and how it’s transmitted and how it’s consumed. That’s another major focus area of that initiative.

Above: Intel is moving fast into autonomous cars.

VB: I’ve seen different kinds of reports about how big 5G is going to be as a contributor to the global economy. What do you think about that? Is this going to transform society?

Topol: It opens new business models. As you talk about a smarter city, or a more efficient factory, or a vehicle that can run autonomously, it does change our behaviors, our habits, and what we can do with our time. I’d agree that 5G will open up many new business opportunities, primarily because of the data that’s coming off these smart and connected machines all around us. The ability to analyze, compute, and harvest that data is going to make us smarter in the way we lay out cities, set up factories, drive cars, and do other things around us.

There’s a tremendous opportunity. I don’t have a specific study we’ve done yet. Our focus is to deliver the technology baseline and the use cases around it. We’re confident that our partners are going to build great business models around it.

Our strategy from the start, as we said at CES, is end-to-end capability. Intel is the only company that sells hardware solutions from the device all the way up through the core and access networks and into the cloud and data center. Our ability to build out that new vertical for a partner – to sit down with GE or Honeywell or a media company and show how that blueprint works in 5G – is a very compelling case for Intel. We can do very quick testing and prototyping and move to commercial solutions. That’s part of why we have the partners coming in and working with us that we do. It’s a big part of our strategy.

Above: Intel and Ericsson achieve first pre-5G over-the-air wireless interoperability between the 5G Intel Mobile Trial Platform UE and the Ericsson 5G Radio Prototype system.

VB: We talked before about how, in some ways, 5G and the bandwidth it brings could allow a shift in where computing happens. If you need it to happen in the cloud, it can happen there, or it can happen at the edge. But then the expansion of demand for that particular bandwidth, at least in the case of 4G, caused the networks to bog down again. Once everyone was able to watch video on their smartphones, they did it, and that brought down the quality of voice traffic on the networks.

Topol: Exactly. There are two or three ways we want to address and mitigate that. The first is to have a strong advocacy position around spectrum. There’s more spectrum out there to be used for these communication types. Opening up more spectrum in the lower frequencies, below 6Ghz, but also opening up—a lot of the prototyping we’re doing in millimeter-wave is to open up that additional bandwidth via spectrum allocation. We’re strong advocates of that globally. We drive, through many of the advocacy groups, that harmonization, trying to have certain parts of millimeter-wave, certain spectrum in sub-6Ghz, be harmonized globally. It’s easier, from a design standpoint, for our radios, and it’s also just a better experience for consumers to transcend between those locations.

The second is offloading what is actually going up through the networks. We talked a bit last time about machine to machine communication. A big part of 5G protocol is not only to make a fatter pipe and higher broadband connection, but to allow more machine to machine communication, where those machines don’t need to communicate up through that local access point or base station. They can communicate directly with each other. That’s a significant offload for those networks.

The third is some of the network transformation technologies that Intel is pioneering. One is mobile edge compute, where it’s putting more of the caching and content at the edge of the network. It’s not something that has to go all the way back through an access network and into the cloud to access and retrieve that. A lot of content can be carried closer on the edge of the network.

Another one is network slicing. With 5G, when you move to a software-defined network, you can slice the business model or the vertical. With automotive, you can slice the way the vehicles connect to base stations and cell towers and up through the network. You can essentially quarantine it from driving by a busy university campus with hundreds of college kids streaming and downloading media, or any other activities that constrain a network. You don’t want that to affect the safety functionality of cars, or the reliability a connected factory might need. Network slicing is pretty critical.

Think of it as spectrum allocation, having these network transformation technologies, as well as offloading a lot of communication and keeping it at a local, machine to machine level.

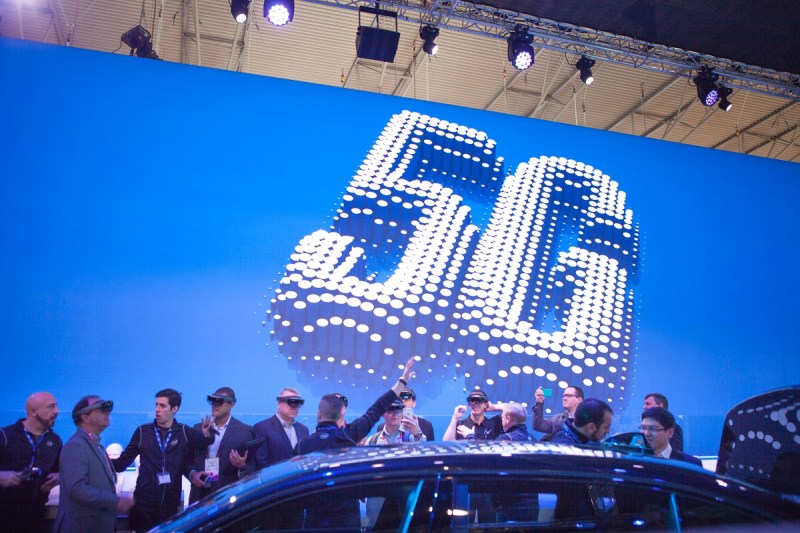

Above: Scenes from Mobile World Congress 2017 on Feb. 27, 2017, including the Intel demonstration booth.

VB: You had a demo on autonomous cars where you could have cameras taking video, analyzing traffic, and passing along warnings to cars about a hazard ahead. How would that example work in this kind of network setup?

Topol: There will be a lot of hardware tools on the vehicle to allow it to see. Whether it’s lidar or computer vision functions, many of those things will be onboard to the car, allowing it to see things that are happening around it. What we were showing with that demonstration is a capability called V-to-X – vehicle to infrastructure, vehicle to pedestrian, or vehicle to vehicle. You’re utilizing the other objects and using a network to give the car vision beyond things it can’t see through the mechanisms in the car itself. Something that’s happening around the corner or further ahead.

V-to-X complements the autonomous driving functions that already exist in the car. We were showing how that functionality is complementary. It’ll bring additional safety, additional efficiency, routing the car the right way if it can see something forward that computer vision or Lidar can’t see. That’s currently a standard being set and put forward through 3GPP. You’ll see it flourish when you get to 5G. That’s the point where you’ve built a protocol and a network where all these machines can speak to each other, speak through a network as necessary, and it can be quickly accessed by anything moving, like the vehicle. You’ll see this start in 4G networks, but it’ll flourish when you get to 5G.

VB: In that particular example, would it be more like local communication happening, and not so much pressure on the network?

Topol: Exactly. It can be that it goes further back into a network. If there’s information that’s valuable for traffic safety, or the public sector, or even the car manufacturer, it can go there. But yes, V-to-X is designed more to give vision to the vehicle where it can’t see through the tools it has onboard.

VB: What other scenarios are the selling points of 5G? What do you think will turn out to be the most valuable applications?

Topol: It’s a tough one, because when we build a new air interface like this—you typically build it with a set of known use cases, but it’s the unknown use cases that will proliferate and in the end benefit from the network you put forward. You always try to build that air interface with as much flexibility as possible. You typically set your targets for bandwidth or latency far ahead of the use cases you have today.

If you look back at LTE—if we were doing this interview 10 years ago, I’d talk about some of the use cases, but the smartphone probably wouldn’t be one of them. It wasn’t even shipping in high volume yet. It was considered more of a novelty. Most of us still carried PDAs. We can see what happened over 10 years — how touch, data, apps, media, and gaming changed the way we look at mobility and the power of something we can carry with us.

We set out several initial tracks. We think the car is something that goes through significant change in the next five to six years. The experience in the car will be more like the one we have in our office or at home. It’ll be a place for productivity or entertainment. We see the capabilities 5G can bring to drones, whether it’s for the pro-sumer or the casual user that wants to do video capture, but even going beyond line of sight. Think of the drone racers that want to do courses covering miles, not just within wi-fi range, or the industrial use cases like doing extended logistics delivery or even remote observation.

We see the same in fixed wireless, where we can beyond the places fiber cables go today for work and enterprise. But to be honest, there are unknowns. A big unknown is where this takes media experience. We work with several media partners. We’re at the tip of the iceberg with VR. When you start to talk about augmented and mixed reality, and going further into what’s called collaborative augmented reality, where more than two people are working in the same mixed reality environment—you’re talking about huge complexity in the way those images and things are captured.

The volumetrics you go through to assemble that image, and then transmitting that between two people—there’s a ton of work to do there, but it’s a 5G network and 5G air interface that opens up those doors. It gives you to the broadband capability for multi-gigabit-per-second connections. It also gives you low latency. When you put on a VR headset, there are probably times where you felt a little dizzy, or the image wasn’t exactly right. The biggest issue, typically, is latency. Getting down to a millisecond of latency on the edge of the network will make that a very crisp experience, without any motion sickness or things like that.

Media and the viewing experience is a big opportunity for 5G. We’re just at the tip of the iceberg, though.

Above: Intel opened an autonomous car lab in San Jose, Calif.

VB: Are you still confident that the U.S. is in as good a spot as other countries or regions as far as preparing for 5G?

Topol: We are. We’ve made good strides in ensuring millimeter wave spectrum is available for use in experimental licenses and testing. It’s important, though, that the U.S. ensures we have sub-6Ghz spectrum available as well. There’s a lot of work going on around that. We see much of the world targeting both sub-6Ghz, this lower frequency spectrum, as well as millimeter wave.

We’re in a good position. That’s based on the assumption that we continue to explore and make sub-6Ghz spectrum available as well. That’s where the first deployments will be for mobility. It’s an easier spectrum to work with for mobile applications, mobile devices. You’ll see millimeter wave start as a fixed capability – home, enterprise, other places – but as those networks start to deploy further, millimeter wave will become a huge thrust and basis for networks as you go into the middle and latter parts of 5G.

VB: Things like net neutrality, are you weighing in on that as far as how it relates to 5G?

Topol: Not really a stance there. The company that Intel is—our position is to build the use cases, the platforms behind both communications and compute capabilities. We’re fairly partner agnostic. We’re looking for incumbents that have great ideas and businesses in technologies that are sold today. We’re interested in disruptors too. This is a business that goes through significant disruption. We’re making sure our prototypes and products are targeting a mix of incumbents and disruptors. But as far as a stance, I’m probably not the best person to talk about that. Again, we focus on the products.

VB: You had a chip available at CES. How is that moving along?

Topol: We’re doing well. That was the radio transceiver that supports millimeter wave and those sub-6Ghz frequencies. We announced the modem, what’s called the base band. That’s still on track for sampling with partners in the second half of this year. That’s when we can move from our mobile trial platforms – those larger flexible boxes that give us 5G capability – to much smaller modules, smaller chipsets that can go into a mobile-like device or a drone or a smaller gateway inside the home. It gives us tremendous flexibility. That’s all on track. We move on to multi-mode solutions integrating 4G and 5G as we go into 2018 and beyond.