Alternative investments like manufacturing financing, real estate debt, and loans have historically been the stuff of hedge funds and large private equity firms. But Milind Mehere, cofounder of Yodle, an internet marketing and advertising company that was acquired by Web.com for $342 million, wants to change that. That’s why in 2015 he teamed up with Wall Street veterans Michael Weisz and Dennis Shields to found YieldStreet, a New York-based digital wealth management platform that lets customers invest in asset classes at minimums as low as $5,000.

To fuel growth well into this year, YieldStreet has secured $62 million in series B equity financing, it announced today. The round was led by Edison Partners, with participation from Greenspring Associates, Raine Ventures, and “a large multi-billion dollar NY family office.” The funding follows a $112.8 million debt and equity series A in June 2018 and brings YieldStreet’s total venture capital raised to $174.8, according to Crunchbase.

The influx of cash will be used to expand YieldStreet’s product offerings and audience to a “broader” set of investors, Mehere said, and to recruit “top-tier” talent and pursue strategic acquisitions.

“We are energized every day to provide access to investment products that put our customers on a path toward financial security and independence,” Mehere said. “This fundraising round validates our vision of defining a new market as the only leader in this category and will allow us to make a huge impact for millions of consumers.”

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

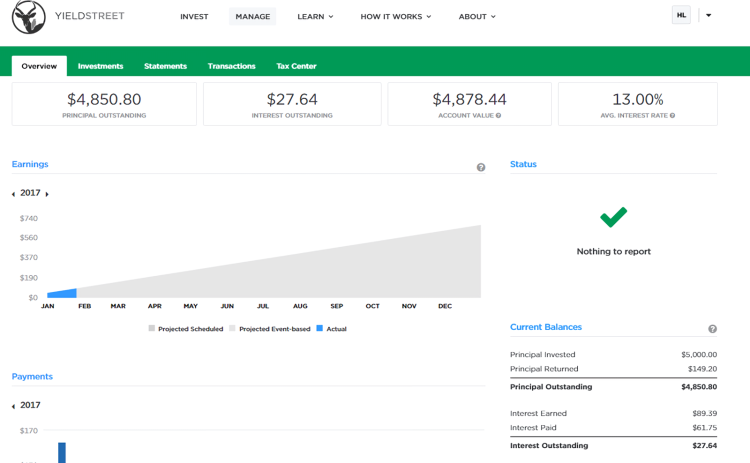

YieldStreet — which has generated an expected 12 percent internal rate of return (IRR) and made more than 300,000 principal and interest payments to over 100,000 investors in four years — backs debt-based investments with collateral, ensuring a fixed interest rate during their duration. In the event a default occurs, investors have legal options to recover the principal and can liquidate the investment to collect interest.

But the real advantage of an investment made in one of YieldStreet’s commercial, real estate, legal, and marine portfolios is stock and bond market independence, Mehere contends. He says the average customer earns target yields of 8 to 20 percent over one- to three-year durations, and that collectively YieldStreet investments have generated more than $50 million in interest. The company also offers money management services through YieldStreet Wallet, an FDIC-insured savings account that promises the roughly 14 million accredited and retail investors in the U.S. — people with $1 million in net worth or who make at least $200,000 a year — 2.2 percent annual returns without minimums.

Alternative investments come with their own risks, of course. Not all are on a fixed payment schedule, and some lenders might not get back part or all of the principal balance. Moreover, there’s no guarantee of a fair market price for investments.

But Edison Partners’ Chris Sugden, who will join YieldStreet’s board, says the company makes every effort to educate customers through YieldStreet University, a collection of resources and information about asset class investment and specific investments on offer.

“True wealth creation opportunities have been either too expensive or off limits for most investors. YieldStreet is going after this market in a way the best innovators do. They are building a multi-product platform that brings a new level of investing inclusion to those looking to build wealth and save for their future,” said Chris Sugden, a managing partner at Edison Partners, who will join YieldStreet’s board. “The impressive and highly capital-efficient revenue growth, paired with a proven product-market fit and strong founding team, compelled us to become a part of expanding this movement.”