Latin America has a lot to offer, but the region throws many challenges in the way of the budding entrepreneur.

One reason for this is numerous weak points and complexities in the overall business landscape. On the World Bank’s ease of doing business index, Latin America is falling further behind developed economies on every key metric.

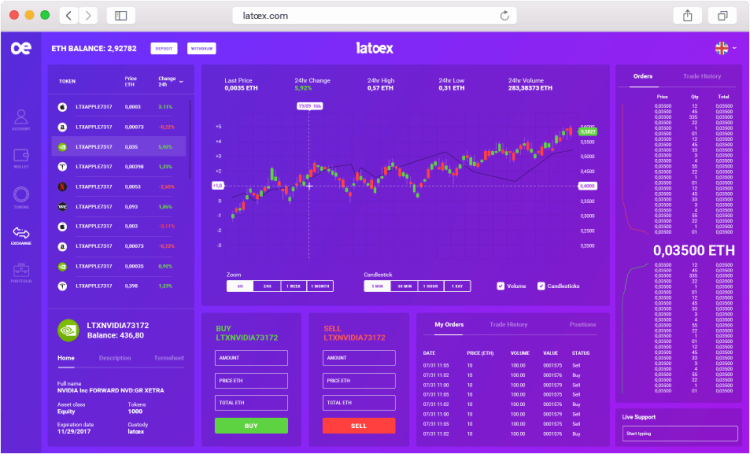

Today, Latoex has announced the launch of its Andes trading platform, which provides a number of tools for the conversion of traditional assets to tokenized assets.

Why is that potentially important for the region as a whole?

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Latin America’s financial markets are composed of assets like stocks, real estate, gold, commodities, carbon credits, and oil. A significant number of these are difficult to transfer physically. Of course, digital trading systems exist, as they do in other markets, but in many cases buyers and sellers still use a piece of paper to represent tangible equity.

That is cumbersome, complex, and difficult to track.

As a result, and thanks to financial regulations that add further complexity to the various economic issues, businesses in the region have taken a serious interest in fiat currency alternatives. The cryptocurrency market, as a result, has flourished in many parts of Latin America.

Latoex offers a blockchain-powered solution that allows companies to run initial coin offerings (ICOs) and create and trade digital assets.

“We offer a process tool to tokenize and exchange assets [security tokens] by the creation of the tokens and their integration into financial institutions,” Latoex CEO Fabio Silva told VentureBeat. “Our tools include an exchange for digital assets, another to tokenize assets, and a wallet in which you can store your assets and tokens.”

The Latin American fiat landscape is famously volatile. The existence of stringent regulations, high inflation, business complexity, and currency devaluation all contribute to the current environment. Blockchain and cryptocurrencies could offer an attractive alternative.

“The Latin America Stock Exchange market is one that is dominated by few players that aren’t ready for the trading of digital assets,” Silva said. “The fiat world volatiles the technological evolution from securitization to tokenization and clears the path toward the dominance of digital assets that are worth 6 trillion dollars.”

The trading hub is maintained by its token issuers, financial institutions, and companies heading to an ICO. Built on the Ethereum blockchain, it uses smart contracts to automate liquidation and simplify back-office processes. The ICO toolkit lets businesses launch their own ICOs and token generation events.

Launching the Andes trading platform is just the first step for Latoex.

“We are live now, working with a significant number of users,” Silva said. “Our upcoming milestones are expanding globally and enlarging the number of platform users. Also, we are preparing for the launch of more products; amongst them are Digital Treasury Bonds and BTC Futures.”

Andes is now available to international investors, excluding those with residence or nationality in Brazil, Canada, China, Estonia, and the United States.