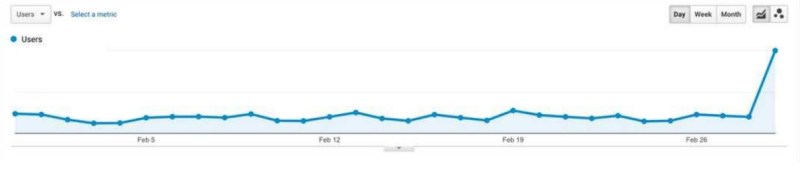

Blockchain-based credit-score app Bloom saw record signups yesterday, following an announcement from credit-scoring powerhouse Equifax about further damages from its massive data breach last year. Equifax said Thursday that 2.4 million more consumers were affected by the breach than originally expected, bringing the total number of people affected to 147.9 million. And it seems a number of people are looking to Bloom for a safer alternative.

Bloom is an Ethereum-based decentralized app (dapp) that promises a high level of security when it comes to personal data, thanks to the privacy and anonymization that blockchains offer. The startup saw so much interest yesterday in the wake of Equifax’s announcement that its site temporarily went down.

And the high level of interest apparently hasn’t let up yet. “Today just passed yesterday for dapp signups and it’s only 3:20 pm,” cofounder Ryan Faber told VentureBeat.

While Bloom’s percentage change in dapp signups yesterday was 1,250 percent above its median signup rate, the total number of signups — about 3,500 — is very low compared to what we usually see with non-blockchain apps, given how young the blockchain app ecosystem is. Still, the app has been live for less than two months. “Since blockchain technology is so new, there still exists quite a bit of technical friction to onboard users to a dapp,” Faber explained. “You currently need to have metamask and a decent grip on how this emerging technology works. We believe that we can be the biggest dapp by the end of 2018.”

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Bloom has also seen a rise in the number of people signing up to participate in its protocol. It currently has a community of more than 50,000 people, including token holders, lenders, data attestors, academic supporters, and enthusiasts, the company said.

Bloom allows traditional and digital currency lenders to work with people all around the globe who aren’t able to get a bank account or credit score through traditional means — or who want to keep their financial data secure. For most U.S. consumers, the idea that you could have any control at all over your credit score is a novel one.

The Bloom protocol has three main components: BloomID, BloomIQ, and BloomScore. BloomID lets users create a global identity that independent third parties can publicly vouch for. BloomIQ reports and tracks a BloomID user’s current and historical debt, information that is encrypted and stored on IPFS. And BloomScore is a score that indicates how likely a person is to pay their debts.

The company has about a dozen lending partners signed up to date, although no loans have been issued yet, Faber said. “We are still in Phase 1, so lending is not yet happening but will be this year.”

Bloom sold over $40 million of its BloomTokens (BLT) in December and launched its app in January. The team is located in San Francisco, New York, Orlando, and Gibraltar.