Digital assets can be a minefield for even the most experienced traders. So when a platform comes along that makes trading easier for the regular consumer, it behooves us all to sit up and take notice.

Craider today launched an automated digital asset management platform that consists of a web portal, a multi-functional exchange, and a mobile messenger bot to execute trades using data-driven analytics.

So how does it work?

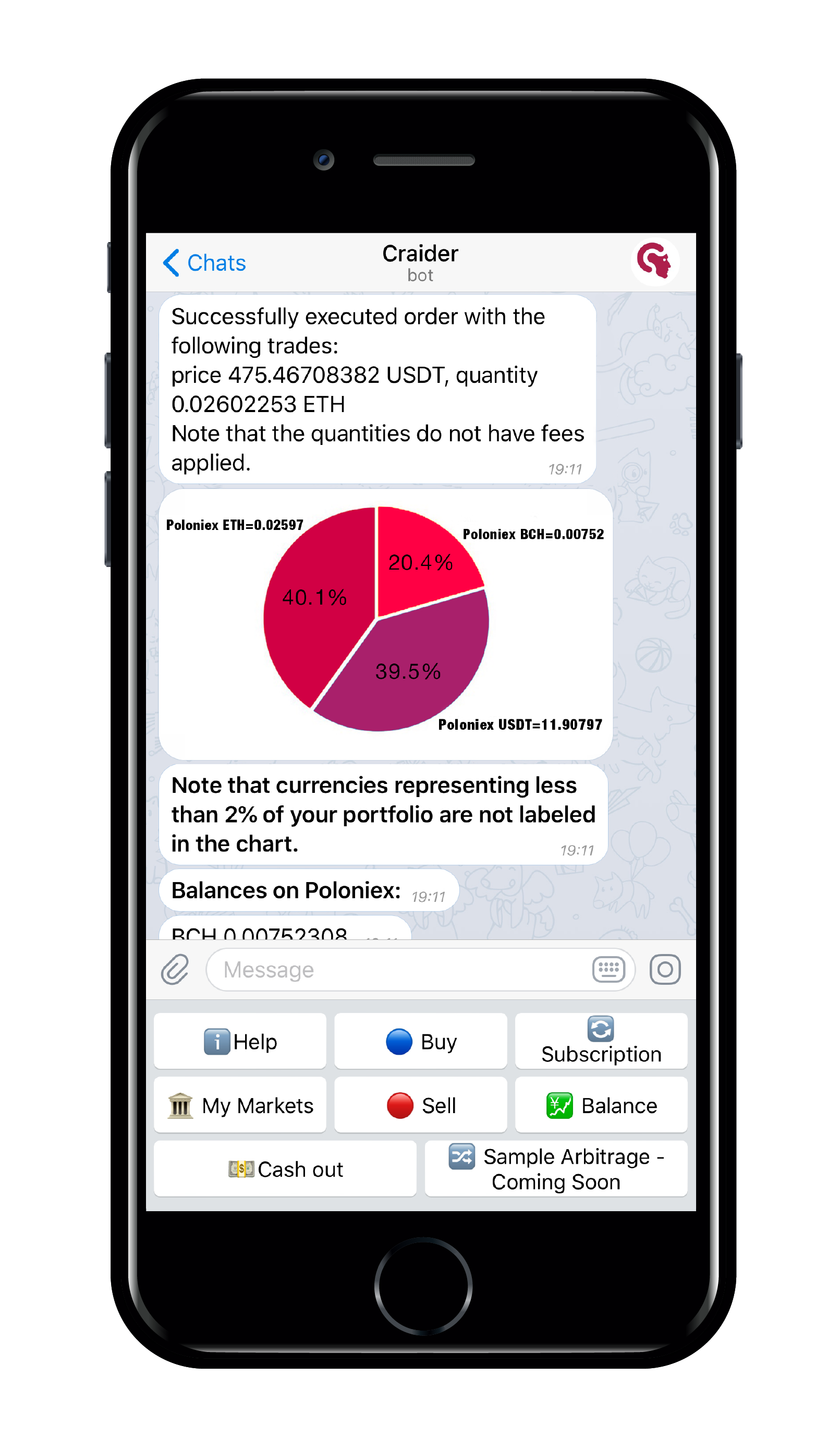

Craider lets subscribers make trades with a single tap of a finger. The bot aggregates multiple exchange accounts and executes trades automatically, sending real-time notifications to alert users to immediate buy, sell, and exchange opportunities.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

The platform offers integrations with significant crypto exchanges, such as Kraken, Binance, and Poloniex, with more options on the way. In addition, Craider offers integrations with most Bitcoin and Ethereum wallets, giving users one-tap automated trades and executions. The platform provides instant industry updates and includes automatic arbitrage detection and execution.

All of this is powered by machine learning. Craider offers trading signals based on daily analysis, not just using current data, but also by learning from aggregated historical data, online sentiment examination, and (soon) social network analysis. While the Telegram bot gives subscribers access to those automated services, the web-based trading platform consolidates data into a multi-exchange, one-window interface that includes cold wallet integration for security purposes.

“Currently, our basic machine learning models send out custom alerts and notifications to our users through a social messaging platform,” Craider CEO and cofounder Boyko Draganov told me. “We are currently live on Telegram and will roll out [on] additional platforms in the future, including WeChat, Line, and Kakao talk. This week, we are launching automatic alerts triggered by changes in the market. The alert gives you the option to buy, sell, or cash out. Users can set up custom parameters — for instance, some users want notifications if the market drops 5 percent and some only want notifications if we see a 10 percent drop.”

Craider intends to add to these notifications soon.

“In the future, users can set up notifications based on specific coins,” Draganov said. “We will be able to alert users if sentiment has gone up or down or if influencers have spoken on the record about the specific coin. We are also in the process of building out portfolio optimization notifications — we can alert you if you are too heavily reliant on one coin, based on your risk profile.”

The machine learning and AI platform Craider is built on comes from Google. Future advances are endemic to the AI platform since Google’s technology has enjoyed a Moore’s Law-busting growth in processing power and speed of several hundred percent in the last year alone.

“We use TensorFlow, developed by Google, which is a leading machine development environment,” Draganov said. “Our models incorporate real-time and historical market data, fundamental and technical indicators, real-time social media, key wallet tracking, and news feeds, as well as keyword sentiment analysis.”

Putting all of this power into a chatbot is significant, as it can help users navigate the blockchain and cryptocurrency marketplace.

“The chatbot is a critical piece for the Craider platform,” Draganov said. “It provides access to the powerful Craider tools at the tip of the users’ fingers. They remain in control of all their digital assets, no matter where they are stored, while on the go.”

Based in Switzerland, Craider has a tier-based subscription model that starts at $99 a month. While that might seem a little costly, it compares favorably with the likes of Cryptotrader, Cryptohopper, and Cindicator, which range from similar monthly subscriptions to starting prices of $200+.

Ultimately, Craider has built the platform from the perspective of a group of blockchain and crypto fans. But the project has, admittedly, been a labor of love for Draganov.

“We built Craider because we are crypto enthusiasts ourselves, but at the beginning, it wasn’t my full-time job,” Draganov said. “I was busy with my day job running marketplace operations at Lazada Group, and found that I was constantly on my phone checking the markets. Let’s just say it wasn’t ideal for my personal life. I saw a specific need when it came to remaining hyper-competitive in the 24/7 crypto space, but not having it consume my life, so I put my attention and time into developing the platform. I found it so useful that I rolled it out to my friends, and they found it so useful that I built a company around the technology.”

Future plans involve introducing the RAID token, an ERC20 token that relies on Ethereum technology, to allow stakeholders to perform seamless and transparent interactions and transactions within the ecosystem.

But what if the market crashes or there is a significant fluctuation in the value of the most incumbent cryptocurrencies?

“What sets us apart from the many auto trading bots out there is that we have a functioning platform — we aren’t in the idea-only stage,” Draganov said. “That said, we are in the process of rolling out some exciting new features, including a Panic Button that will allow users to cash out with the press of a button, rather than trying desperately to log onto multiple web pages and exchanges, which is time-consuming. And in times of volatility, every second counts. We’re also setting up direct integration into the fiat world.”