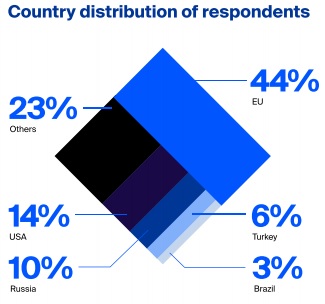

Japan will lead the world in cryptocurrency adoption, according to a survey of crypto investors my team at Waves conducted last month. We surveyed 678 cryptocurrency investors from the EU, the US, Turkey, Brazil, Russia, and other countries to gauge their level of confidence in blockchain technologies and currencies.

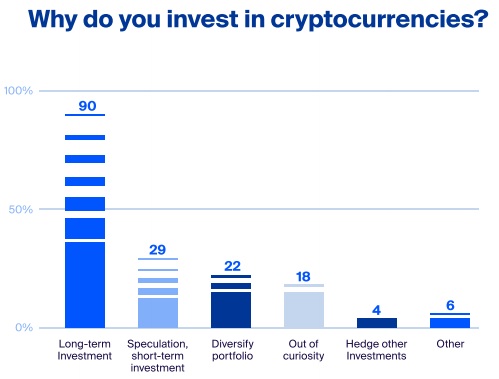

Almost all of the respondents we interviewed (90 percent) believe in the future of сryptocurrency and are investing with a long-term perspective. Twenty-nine percent said they were making short-term, speculative crypto investments. Twenty-two percent said they had invested in cryptocurrencies in order to diversify their assets, and 18 percent out of curiosity. Twenty-two percent said they thought Bitcoin could grow to $20,000.

Most crypto investors in the survey had never invested in other forms of assets. Only 32 percent of them had invested in shares or bonds, and 14 percent in real estate. Another 17 percent of investors had sought returns from bank deposits.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

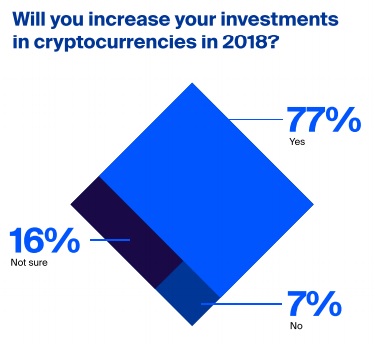

Despite fears from many experts that there’s a bubble forming in the cryptocurrency market, investors indicate they do not intend to reduce their investments in these types of assets. In fact, 77 percent of respondents said they expect to increase their exposure to cryptocurrencies in the coming year. At the same time, crypto investors are aware of potential risks. Fifty-one percent of them consider the risks of losing funds moderate, and one in five recognize a high risk.

Twenty-seven percent of those we polled expect Japan to become the global leader in the development of the cryptocurrency industry next year, followed by Russia (15 percent) and South Korea (15 percent), and the U.S. in fourth place (14 percent).

In addition, 65 percent of crypto investors believe digital coins will be integrated into the real economy over the next five years. A further 25 percent consider this a possibility, and only 10 percent think it unrealistic.

Investor perspectives varied quite a bit by geography, though. American investors, for example, were more likely to see the U.S. as a leader in blockchain and cryptocurrencies. Twenty-nine percent of the Americans we polled said the U.S. will become the global leader in the development of the cryptocurrency industry next year. U.S. investors placed Japan in second place (27 percent), and South Korea third (12 percent).

Almost all of the Americans interviewed (94 percent) believe in the future of сryptocurrency and have therefore made their investments with a long-term perspective. Cryptocurrencies have also provided an instrument for short-term speculation for 35 percent of the American investors we polled. Twenty-four percent of Americans invested in cryptocurrencies in order to diversify their assets, and 19 percent invested out of curiosity. Eighty-five percent plan to increase their exposure to cryptocurrencies in the coming year.

Over 69 percent of U.S. crypto investors polled have already invested in other assets. Contrast that with EU investors, the majority of whom haven’t previously invested in other assets.

Eighty-nine percent of the Europeans interviewed believe in the future of сryptocurrency and are investing with a long-term perspective. European respondents expect Japan to take the lead in the crypto industry, with the EU in second place and Russia in third. Fifty-nine percent of European crypto investors believe digital coins will be integrated into the real economy over the next five years.

Alexander Ivanov is CEO and founder of the Waves blockchain platform.