Presented by treehouse

If you’re a young professional in the U.K. at the moment, particularly in London, two numbers should give you a lot of food for thought:

16 and 2,350.

Sixteen is the number of years a ‘skilled service worker’ needs to work in order to be able to buy a 60m2 (650 square feet) flat near the city centre in London, according to a report by UBS:

2,350 U.S. Dollars (1,800 GBP) is the average rent in London, according to a study posted on Reddit not too long ago, the tenth most expensive out of 540 cities looked at world-wide, and the most expensive in Europe.

A report by the Institute for Fiscal Studies found that today’s young adults are significantly less likely to own a home at a given age than those born only five or ten years earlier. At the age of 27, those born in the late 1980s had a homeownership rate of 25 percent, compared with 33 percent for those born five years earlier (in the early 1980s) and 43 percent for those born ten years earlier (in the late 1970s). That’s an 18 percent difference between those born a decade apart.

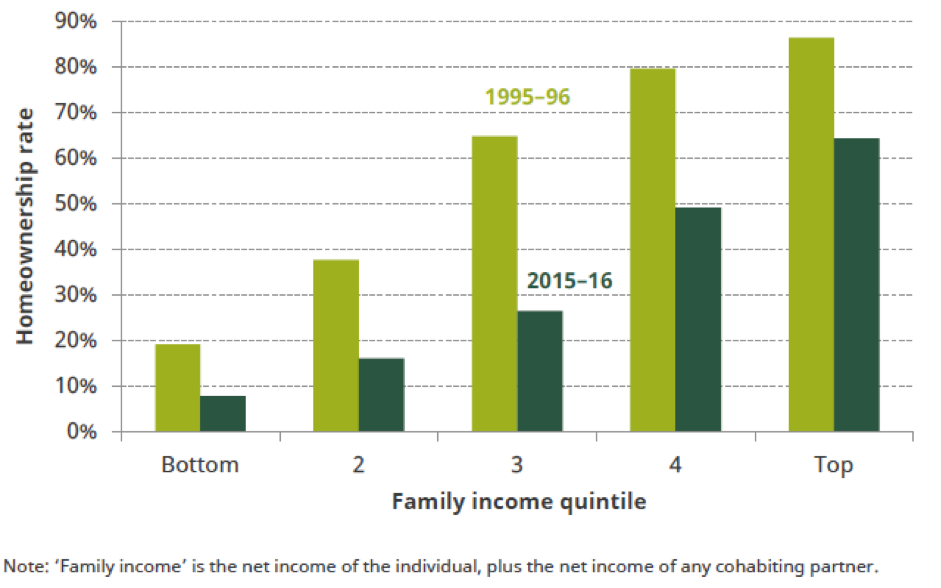

The fall in homeownership has been sharpest for young adults with middle incomes. In 1995–96, 65 percent of those aged 25–34 with incomes in the middle 20 percent for their age owned their own home. Twenty years later, that figure was just 27 percent. A 38 percent difference, which highlights what everyone knows; income inequality has accelerated.

The key reason for the decline is the sharp rise in house prices relative to incomes.

Mean house prices were 152 percent higher in 2015–16 than in 1995–96 after adjusting for inflation. By contrast, the real net family incomes of those aged 25–34 grew by only 22 percent over the same twenty years. As a result, the average (median) ratio between the average house price in the region where a young adult lives and their annual net family income doubled from 4 to 8, with all of the increase occurring by 2007–08.

This increase in house prices relative to family incomes fully explains the fall in homeownership for young adults. Moreover, young adults from more disadvantaged backgrounds are less likely to own their home, even after controlling for the kind of job they have and other characteristics.

Tellingly, the percentage of individuals living with their parents, for people born in different years, has increased by age with each successive generation:

It’s no wonder then, that millennials are expecting more from the property market: transparency, affordability, and digitization.

The rise in real house prices fast outpacing family income coupled with costs of living going up, make for the perfect storm when it comes to millennials saving up to buy their first home.

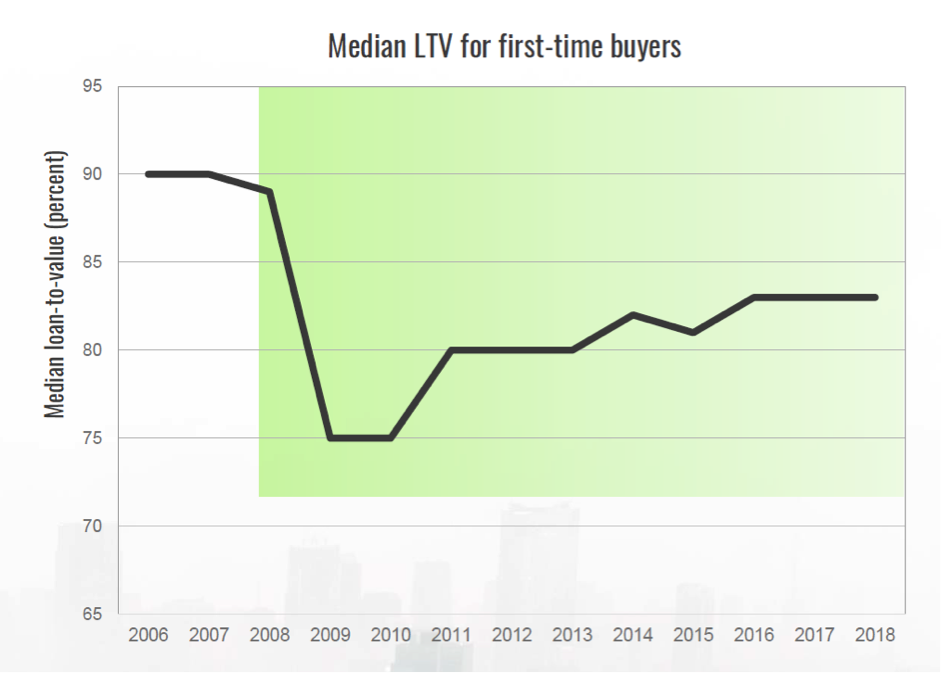

On top of this, banks are asking higher upfront deposits to grant mortgages since the 2008 financial crisis. To put this in perspective the median Loan-to-Value (LTV) ratio pre-financial crisis was at 90 percent compared to currently a ratio closer to 83 percent. In other words, while one needed to have 10 percent of the total value of a property to secure a mortgage 10 years ago, now one needs around 17 percent.

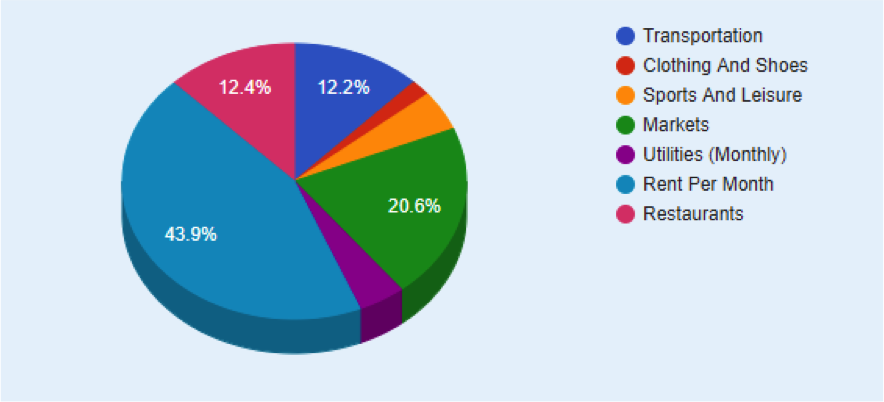

Properties are not only more expensive than before, the means of financing their acquisitions are also more stringent and time consuming. The time required to save for a larger deposit, coupled with a double whammy of higher living costs, means a longer time spent paying rent. In London for example, almost 44 percent of income goes towards rent, while nearly 21 percent goes towards food.

It is also important to look at how First Time Buyers (FTBs) save for their deposit and what kind of concern this is creating. Generally speaking, people will set aside a small portion of income each month in a savings account that returns a maximum 1.7 percent return, or an ISA.

Over the last decade though, savings account rates have struggled to keep up with price inflation. And chances are that between the day from which an FTB has started to save and the day they finally have the necessary deposit to secure a mortgage; the house they targeted has gone up in value.

Millennials in particular are locked in an eternal race to save enough money to access a mortgage at a reasonable price. For this reason, younger generations are either renouncing acquiring a property, or choose to find a home outside of town, and usually far from their desired location.

Current situation of the real estate investment scene

Acquiring a home is a complicated, long-term process. Some young professionals are not necessarily looking at buying a property at the moment but would like to invest or feel they have invested in the real estate market, so as to not feel they have missed the growth. At the same time, people are looking for alternatives that return more than a traditional savings account.

The current alternative to buying a home physically consists of investing in Real Estate Investment Trusts (REITs) or Exchange Traded Funds (ETFs).

A REIT is essentially a company that owns, operates, or finances real estate, and must meet certain regulatory guidelines to qualify as one. Individuals can invest in REITs by purchasing their shares directly on an open exchange or by investing in a mutual fund that specializes in public real estate; in itself a rather long-winded process and not always as cost effective as it could be.

An ETF, essentially invests in stocks that are issued by companies or REITs and tracks an index. Again, this involves opening brokerage accounts, having a sizable chunk of money to invest and lacks the targeted approach to property investment that many people want.

The lack of transparency in regards to fee structures is a true issue for individuals that have little or no in-depth knowledge of financial markets. For instance, an investment in an ETF will have a myriad of different fees, that once put together, result in a considerably high tally: stock exchange fee, ETF expense ratio, broker commission, monthly active fee, bid-ask spread, etc.

In order to open a brokerage account there is minimum investment requirement that ranges from £5k to £10k depending on the broker. In other words, if one wants to invest in those products to have exposure to real estate markets, it is going to require an already sizable amount of money to allocate, and bearing the burden of successive fees that are not clear from the beginning.

The treehouse solution

treehouse is a hybrid centralised-decentralized real estate investment platform. We list properties from sellers, fractionize them through tokenization, and make these portions of the property available on our secondary market. This process makes it accessible to a multitude of buyers. There are no minimum investment requirements; fees are very transparent and more importantly — reasonable. Once portions of a property have been purchased, the buyer receives the associated benefits with owning a property: capital gain and rental yield.

Our platform is available to everyone, whether institutional or retail. And as millennials ourselves, we wanted to create as part of our platform a mechanism that will help young professionals access the property market quicker, cheaper, and to bring property into the 21st century.

For example:

A young professional has the equivalent of 5 percent deposit of the property they desire. They are earning enough to pay for an 85 percent mortgage at current market rates. Meaning, they have to make up for the remaining 10 percent to reach a 15 percent upfront deposit. There’s a choice here:

- traditional one, where the customer puts available income onto a savings account at the relevant rate on a monthly basis

- treehouse one, where available money is invested in unique property portions (called GALs), that provide access to house price growth + net rental income (reinvested every month)

Irrespective of where the real estate market goes from here, on treehouse the buyer is now hedged against movement in prices, while collecting a rental yield, which means it is faster to get to a 15 percent saving position.

The faster real estate prices grow, the more powerful treehouse’s product becomes, as the alternative route using standard savings rate struggles to catch up with house price inflation.

On average when looking at different scenarios, we estimate that for a 5-year investment period, a customer will reach 15 percent deposit between 7 to 11 months earlier than with a traditional savings account.

At treehouse, we provide what people are expecting more from the property market: transparency, affordability and digitization.

Raz Iordache is Founder of treehouse.

Sponsored posts are content produced by a company that is either paying for the post or has a business relationship with VentureBeat, and they’re always clearly marked. Content produced by our editorial team is never influenced by advertisers or sponsors in any way. For more information, contact sales@venturebeat.com.