If you have been in crypto for more than two minutes, you know one simple fact: Coin prices are really volatile. And that volatility isn’t just tough on investors. It’s also tough on those who provide services to crypto startups in exchange for tokens — and for the crypto startups themselves, who are having to run a business with an ever-changing budget.

Crypto startups often negotiate deals with service providers (such as for-hire developers, advisors such as myself, and marketing services firms) in Bitcoin, Ether, other popular coins and/or their own tokens. But all of these are very volatile. And a number of their expenses and creditors require fiat, creating quite a challenge, since, the USD or EUR-denominated value of the project can double or get cut in half in a matter of days, creating all kinds of cash flow issues for the startup and the service provider.

The crypto startup team and those who provide services to them in exchange for cryptocurrency are assuming currency risk without the hedging experience that large multinationals have.

As a marketing advisor to cyrpto startups, I have experienced this myself many times, and it’s a real pain point as well as a risk. This lack of stability in and out of fiat and between cyrptocurrencies is a barrier to mainstream adoption.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

If a startup runs a (successful) ICO, they have a pile of ETH and a pile of their own tokens in their treasury. This should form the basis for their burn rate in the months to come, but as the value of both assets could swing dramatically, the startup has a reduced ability to accurately forecast expenses. A front-end developer one month may charge 10 ETH; the next month, the same developer may cost 20 ETH.

In this type of environment, it’s difficult to predict and model future costs. While some people like roller coasters, operating entities do not. They value stability.

Stablecoins to the rescue?

Given the growth of the crypto sector in the past year, significantly increased interest by institutional investors and the high volatility of many assets, the concept of stablecoins has seen quite a bit of interest.

As the name implies, stablecoins are crypto-assets that seek to hold a consistent value vis-a-vis another currency. There is a lot of great material out there on the topic. You can read this overview from Argon Group, this one from Haseeb Qureshi, this one from Leslie Ankney, or this one from Myles Snider of Multicoin Capital.

Qureshi’s piece does a nice job of outlining the differences, both pro and con, of “fiat-collateralized,” “crypto-collateralized,” and “non-collateralized” stablecoins.

In short, fiat-collateralized stablecoins are backed by a “regular” currency such as USD or euro. Crypto-collateralized stablecoins are backed, typically, by Ether. Non-collateralized stablecoins rely on a combination of algorithms and smart-contracts, using supply-demand principles to maintain price equilibrium

If stablecoins can prove themselves, an entirely new wave of crypto-related investment is likely to be unleashed. Not only will more service providers and partners enter the eco-system to support crypto-native startups, but institutional investors and large enterprises who want to manage cash flows with some degree of predictability will get comfortable with larger stakes. In addition, projects that raise funds via ICO will have the opportunity to mitigate volatility risk of their assets and do more effective long-term planning, increasing their odds of success.

On the other hand, if stablecoins prove faulty, many worthwhile projects could fail for reasons that have nothing to do with technical merit.

Meet some of the players

Stablecoins are certainly an appealing concept, which is why one of the newer ones, Basecoin (since renamed Basis), has amassed a huge war chest of $125 million from a long list of top-shelf investors.

The first stablecoin I ever heard of (and one of the originals) was DAI developed by MakerDAO. When I first read the whitepaper over a year ago (actually, I read it 3-4 times), I struggled with it. The mathematics were intense, but the concept of using smart contracts and price oracles via a protocol that could either increase or decrease (aka “burn”) the supply of DAI to maintain a price of $1 was undoubtedly innovative.

In their arrangement, you initially need to overcollateralize the DAI you get with an excess amount of ETH, so that your value (relative to USD/EUR) is protected. As Argon explains:

“One needs to deposit, for example, $200 worth of ETH to receive $100 worth in stablecoins in return. In this case, even if the price of the underlying asset depreciates by 20%, the stablecoin can still keep its price stable as there are still $160 worth in ETH collateral backing the value of the stablecoin.”

You can see a potential downside immediately.

What if the value depreciates even more? That’s where “margin call”-like feature comes in, requiring you to send more Ether into the smart contract or risk losing you DAI.

Ah, great, but what if the value REALLY falls? Well, then, it would appear we are in so-called “black swan” territory, and no one really knows what will happen.

It’s easy to be skeptical, but there are plenty of believers out there. Over the past year, some much better explanations of Maker have come out, and there are people I really respect, like Nick Tomaino, who are really big fans. For that reason alone, I’m taking the category seriously.

And there are plenty of other stablecoin contenders trying out different models.

Tether goes for the “fiat-collateralized” approach, backing each Tether 1:1 with USD. With a market cap over $2 billion, it is the most widely-used stablecoin, but it has seen quite a bit of controversy, with questions surrounding its business practices.

A new entrant to the ring, Carbon raised $2 million in a seed round last month and uses Hedera Hashgraph, a new type of distributed ledger that is gaining a lot of attention. And there are many more, including Goldman Sachs-backed Circle, which recently announced it had raised $110 million.

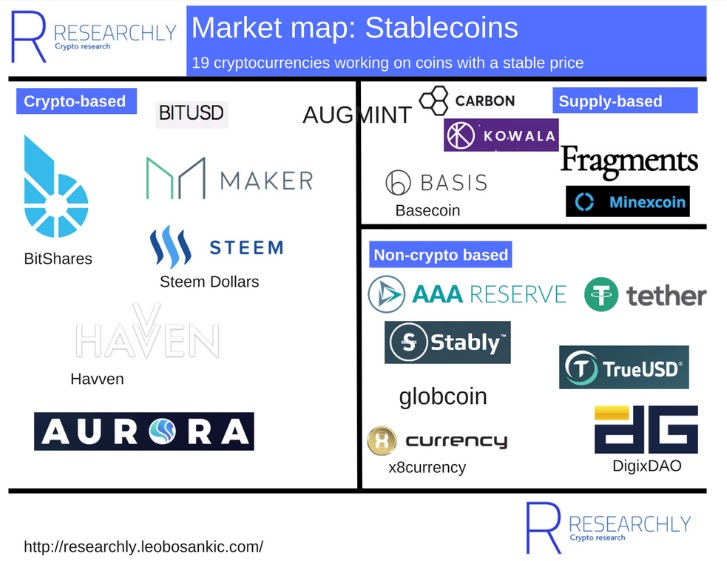

Leopold Bosankic has put together a solid chart and analysis that counts at least 19 different stablecoin projects.

Like anything else in crypto, you really need to do your homework on the credibility of each team.

(Note: Bosankic calls “supply-based” what Qureshi calls “non-collateralized”.)

Are stablecoins doomed to fail?

I’m not an experienced global currency speculator, and there is a lot about currency markets I don’t understand. But I struggle with the idea that any two currencies can ever be kept at perfect 1:1 parity over the long haul.

I don’t know enough about how George Soros famously broke the Bank of England, but I do know he did it because the effort to keep the pound at a constant rate of exchange with the German mark was failing.

Other countries ranging from Argentina to Zimbabwe have also attempted 1:1 parity with not so great results.

And, as Qureshi points out, each of the types of stablecoins has a weakness.

-

Fiat-collateralized requires you to trust a centralized third party to hold your dollars (or euros).

-

Crypto-collateralized creates a dependency on the stability of the cryptocurrency on the other side of the equation.

-

Non-collateralized requires continual network growth in the form of new investors who can provide capital to support a falling currency value.

While Qureshi is skeptical, long-time crypto-industry expert, Preston Byrne, is outright against the idea.

He’s written multiple times that Stablecoins are doomed to fail, Stablecoins are doomed to fail, and Stablecoins are doomed to fail.

Most recently, he published Basecoin (aka the Basis Protocol): the worst idea in cryptocurrency, reborn, calling Basecoin — and the broader sector — an “economic dumpster fire.”

His logic is impressive and well-documented, drawing comparisons to efforts by a number of countries to keep exchange parity with the USD. The bottom line, he says:

“These situations are an object lesson in why you don’t try to peg currencies: because you are unable to hold the peg any longer than you can afford to subsidize your differences of opinion with the market. Once you run out of firepower, the peg breaks and ceases to have any useful meaning.”

No clear verdict

I’m still undecided on the long-term success probabilities for stablecoins.

On the one hand, we know that black swan events do happen. That means a non-free-floating currency could be extremely vulnerable and have a difficult time maintaining its peg.

At the same time, the beauty of crypto (or one of the beautiful components, at least) is that it makes brand new things possible (e.g smart contracts, DAOs, decentralized infrastructure, peer-to-peer private electronic cash). Based on that fact alone, it may be premature to count them out stablecoins entirely.

For crypto to really take off, the industry would benefit from less volatility overall. While we may not get to the digital equivalent of a Swiss Franc, which has not changed significantly since 1879, an asset that can largely hold its value in the face of normal volatility (whatever that is) could be very appealing.

Special thanks to Don Bowden of BuilderChain.io for his great feedback on this article.

Jeremy Epstein is CEO of Never Stop Marketing and author of The CMO Primer for the Blockchain World. He currently works with startups in the blockchain and decentralization space, including OpenBazaar, Zcash, ARK, Gladius, Peer Mountain and DAOstack.