Smartphone users were more willing to download new apps in January than they have in a year, according to a report by mobile marketing firm Fiksu DSP. But the cost of acquiring loyal purchasers of items in apps and games rose.

It was a mixed result, with more app installs and less loyalty. Fiksu’s January indices showed decreasing costs to drive installs across both iOS and Android devices and increasing costs to acquire a user who makes a purchase.

The data from Fiksu DSP tracks more than 38 trillion marketing events including impressions, clicks, downloads, registrations, purchases, and other loyal user events across 4.1 billion devices.

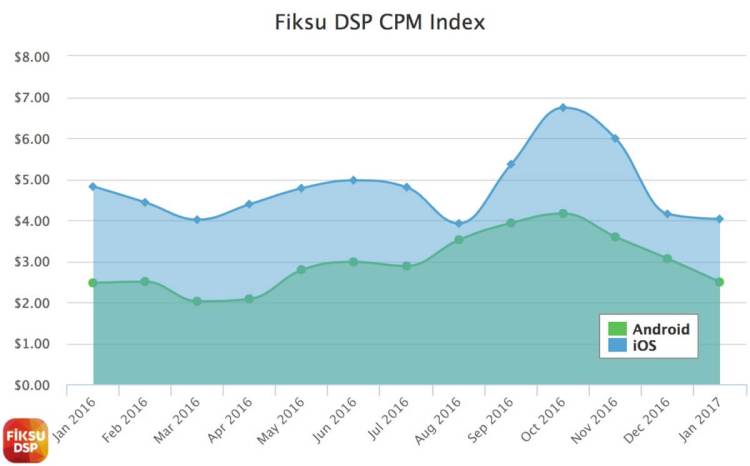

Costs of advertising in apps – measured by the cost-per-thousand (CPM) – fell across both iOS and Android during January, continuing a trend dating back more than three months. The CPM on iOS fell in January to $4.03 while Android dipped to $2.49.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Back in October 2016, CPM on iOS was $6.74, with CPM on Android at $4.16. That was the highest cost for advertising apps in over a year, and it was driven by the launch of the iPhone 7.

Compared to a year ago, however, January’s media costs on Android were up 1 percent and down 16 percent on iOS.

With the cost of media going down, apps across both Android and iOS are having an easier time driving new installs. Fiksu DSP’s findings correspond with rising iPhone 7 adoption rates, which may correlate with Apple raising the minimum iPhone storage from 16GB to 32GB. With more space, users are more likely to download additional apps.

Above: Cost per purchasing user in January.

During the month of December, cost per purchasing user (CPP) on iOS dropped by 23 percent. January exhibited a course correction, with CPP rising 21 percent, back to the approximate costs experienced during the fall of 2016. From a year-over-year perspective, it was slightly more expensive to earn a purchasing user in January 2017 than it was in January 2016.

CPP on Android also dropped considerably in the last month of 2016 but only rose by 4 percent in January. Meanwhile, Android’s year-over-year increase in CPP mimicked iOS, rising 11 percent. Overall, during the month of January it was less expensive to acquire a purchasing user on Android than on iOS, a long-standing trend that had briefly flipped leading up to the 2016 holiday season.

“The rise in CPP across the board indicates that while apps are driving installs, there’s an ongoing struggle to find the right loyal users who will make a purchase or take another high-value action,” said Tom Cummings, the vice president of new market development at Fiksu DSP, in a statement.

This could be a result of poor targeting methodology on the part of brands. A recent Fiksu study found that 50 percent of consumers see ads that are almost never relevant to their needs and preferences.

While consumers continue to be willing to try new apps, they take in-app actions quite selectively. The same study revealed that 79 percent of smartphone users add at least one new app when they get a new device, but 87 percent use less than 10 apps on a daily basis.

“Most Apple users are on their third or fourth iPhone by now,” said Cummings. “They might try out a few new apps, but they probably already know what they’ll be using on a daily basis. Meanwhile, Android marketers are having better luck finding users willing to invest more time with their apps.”