It’s August in Europe, so what better way to kick back than with a data intensive analysis of seed investment rounds on the continent? Let’s take a look at how the first half of this year has shaped up and assess any threats and opportunities for founders.

1. Invested capital and volume

Volume on a dollar basis has increased, though the absolute number of deals has decreased.

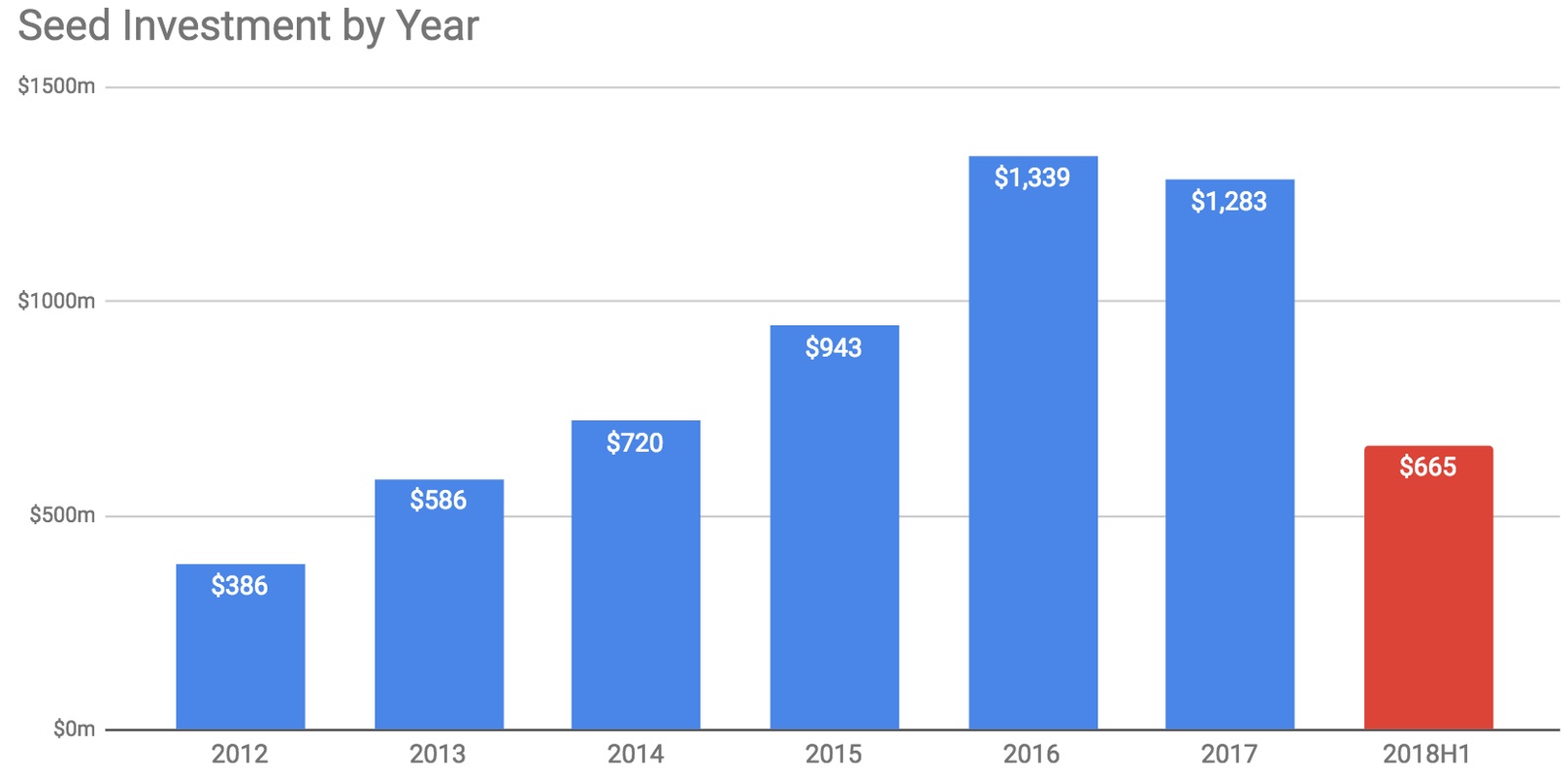

There were $665 million-worth of seed deals completed in the first half of 2018. Extrapolating this out to end of the year, that’s a $1.33 billion annual run rate, inline with our 2016 high. This is a 44 percent increase on a dollar basis over H1 2017, which came in at $463 million. The first half of 2018 saw 789 seed deals done in Europe versus 873 in H1 2017, a 10 percent decrease.

Advice to founders: There’s more capital than ever at the early stages in Europe. Early stage investment volume has been trending upwards since 2012, though it seems to be stabilizing. With a healthy levels of capital being deployed at seed stage, it’s ever more important to choose partners that will give your startup the best chance to grow. Solve for growth of your company, not vanity fund raisings.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

2. Deal size

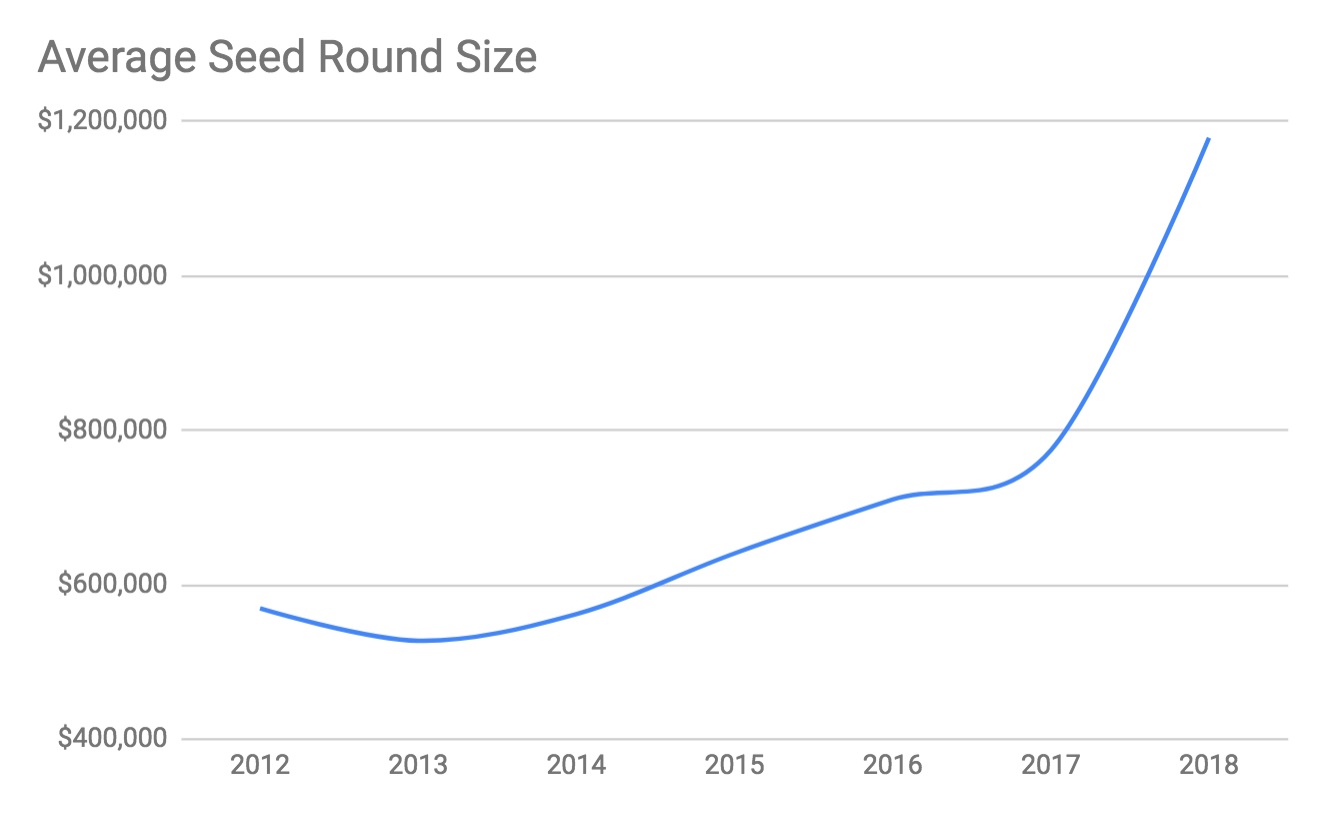

Rounds are getting bigger and might have reached a cyclical high.

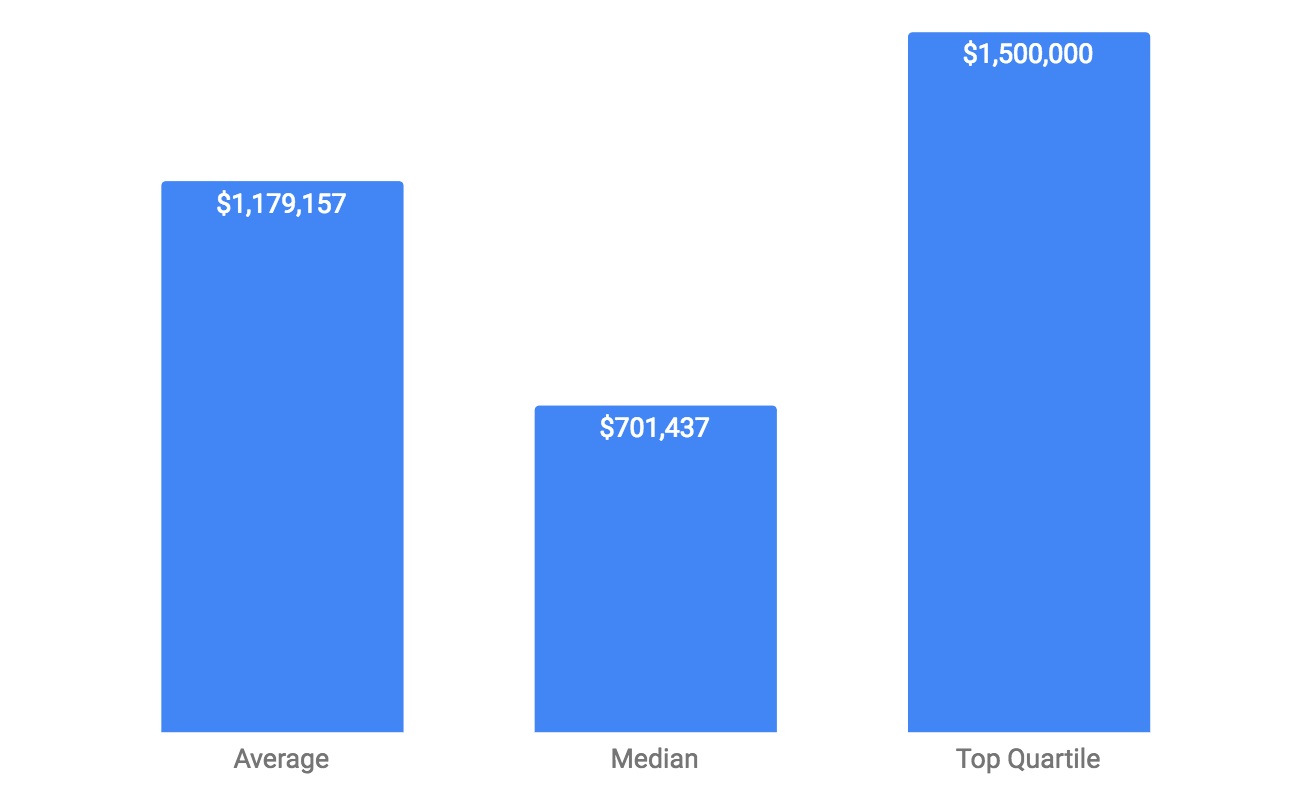

In H1 2018 the average seed round was $1.17 million.

Interestingly, this is a 33 percent increase in average deal size versus H1 2017, which saw an average round size $890k.

So evidently rounds have gotten larger. But how does deal size compare with historicals?

Advice to founders: More capital is going into fewer deals, so the bar for raising seed funds is getting higher. With increasing round sizes, generally come increased valuations. Whilst these heightened valuations might seem useful for purposes of controlling dilution, finding yourself too dilution sensitive at the seed stage may further hinder growth down the line. Do not forget that market terms are already fairly founder friendly. Semi-sensible valuations backed by aligned investors should be your key focus. Taking a lower valuation from a better investor seems counterintuitive but may well be the difference between success and failure. Your startup’s growth can be propelled by value-additive introductions to talent, customers, etc. A higher valuation will not hire your next engineer or convert your next client.

3. Ecosystem dispersion

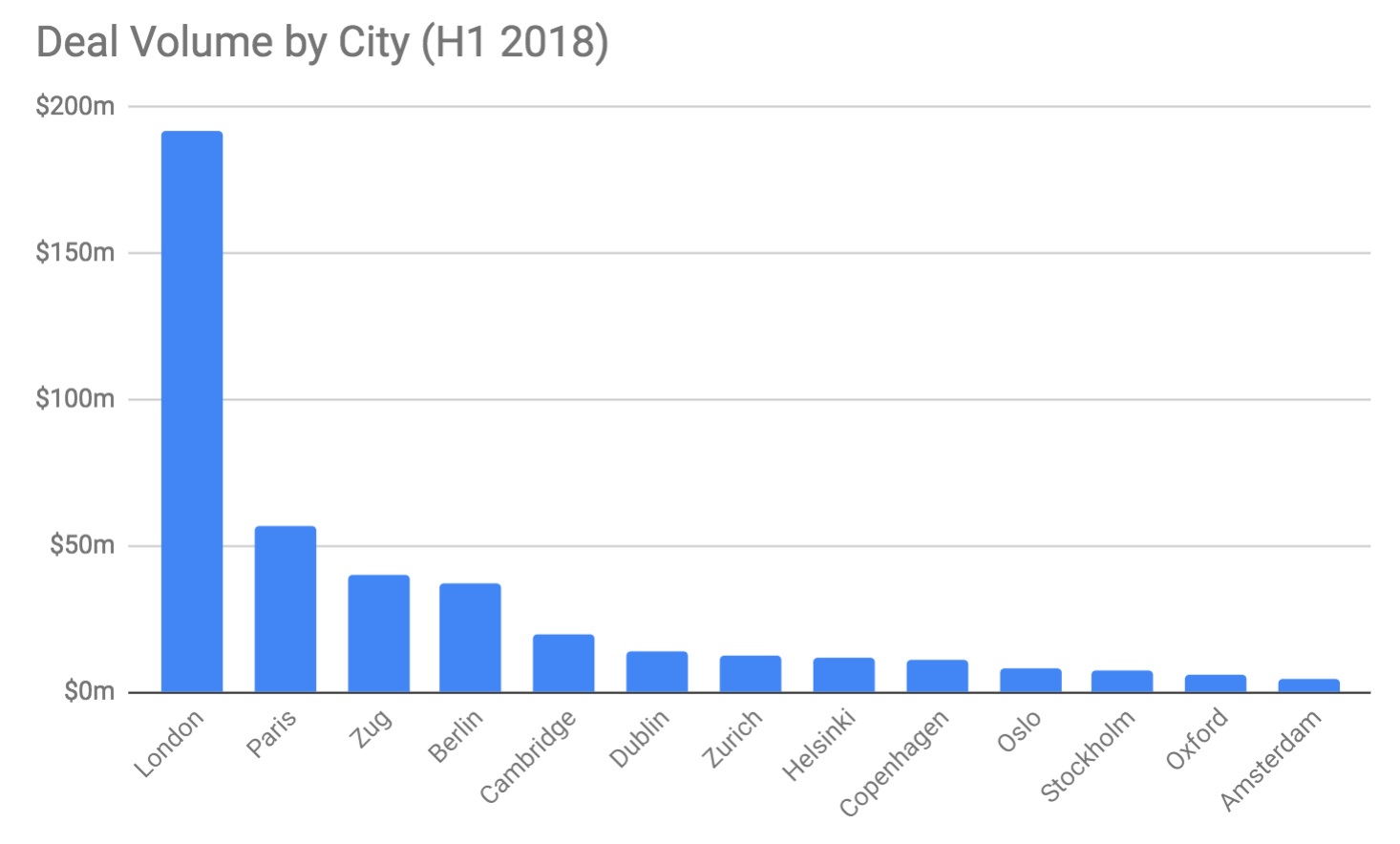

A crypto-fueled new entrant, Zug, has displaced Berlin as Europe’s third largest city by deal volume.

Forty-nine percent of seed funding (on a dollar basis) was allocated to startups in the top four cities, leaving a long tail of European cities picking up the second half.

Let’s have a look at how this compares with H1 2017:

- After the Brexit vote, London continues to dominate seed funding, growing on an absolute and comparative basis.

- Interestingly, Zug, Switzerland is now a significant player, buoyed by the explosion of companies in Crypto Valley. Note that this chart only shows equity financings; if it included all IC funds, Zug would have an even larger presence.

- Just off the podium, Cambridge is chasing Berlin in terms of size, though the two cities are disparate in terms of company makeup. Cambridge continues to become important as it leverages its engineering and deeptech talent coming out of local academia.

Advice to founders: London is still the best place in Europe to build a venture-backed startup. The depth of London’s ecosystem (and nearby Cambridge-Oxford) continues to outpace other European cities even in light of the imminent Brexit. The city has the highest concentration of angel investors, VCs, accelerators, and ultimately capital. It is also home to 13 of Europe’s 34 unicorns. This provides the most fertile environment for talent, funding, and mentoring. The immediate threat to London’s dominance is a post-Brexit world where hiring foreign talent is constrained and UK companies face difficulties trading with foreign counterparts. It’s worth bearing in mind, though, that most European investors have coverage across the continent — great companies can be started anywhere, although you may hit a cap on hiring talent faster in some areas.

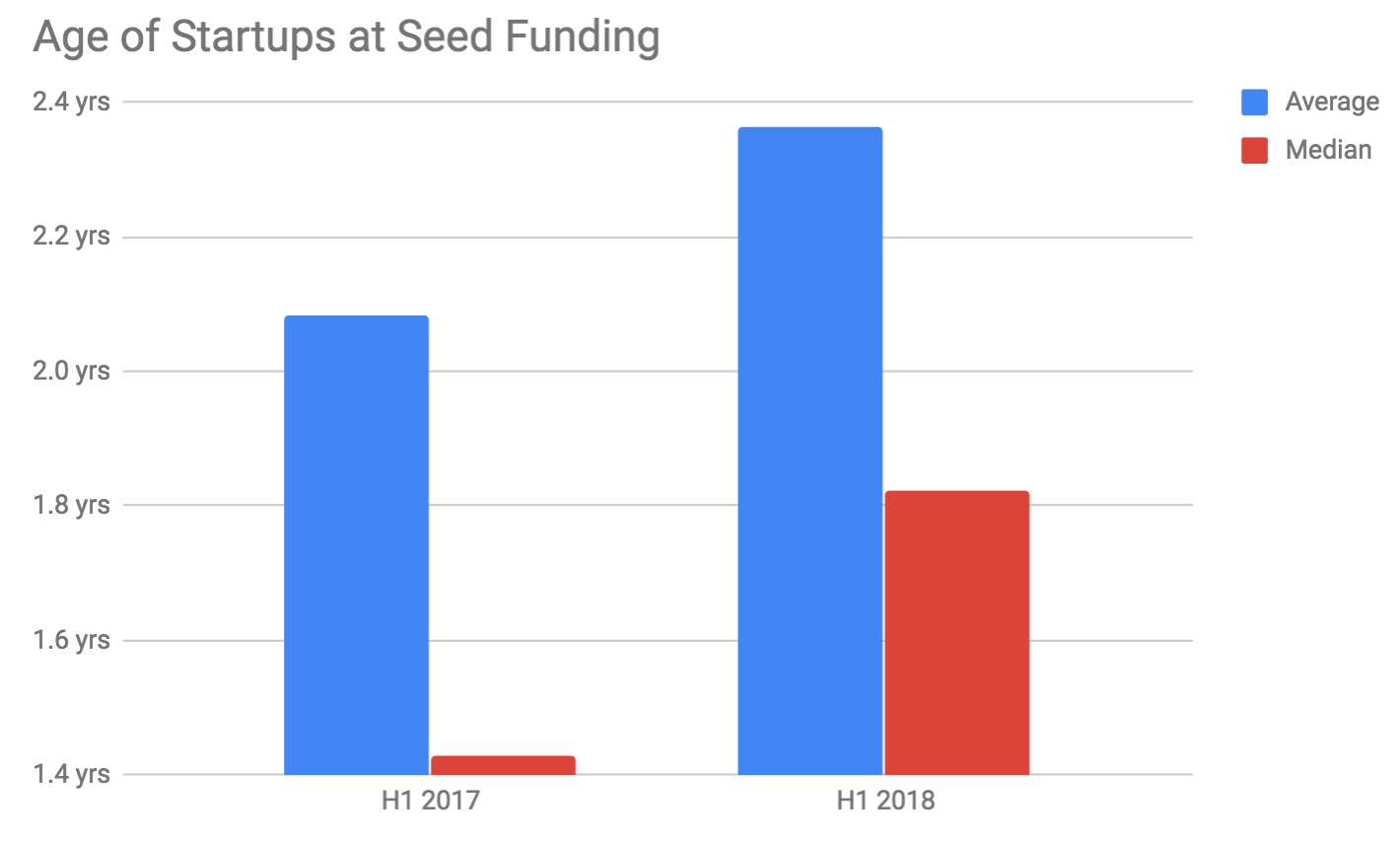

4. Age of startup at seed funding

Currently, the average age of startups at the time of seed funding is two years and three months.

Compared to H1 2017, the average and median age of startups at the time of seed funding has increased.

Let’s now look at whether startup maturity has any bearing on the amount of capital raised:

The trendline is softly sloped upwards, which indicates a small relationship between increased age and capital raised at seed. Still, unless bootstrapped companies keep up with venture-scale growth targets, it’s likely that some investors might see a prolonged timeline to raising as a negative signal if ailments are present (faltering traction, inability to ship, strategic incoherence, etc).

Advice to founders: Timing of funding rounds should be based on a combination of when your company requires capital and when your metrics show you can translate that capital into further growth. Financings should be viewed as company inflection points to further accelerate growth; they are not the end game. Companies raising seed rounds are no longer a founding team and a deck. With the lowering of barriers to company creation (AWS, freelancers, atomization of the startup stack, etc.), founders can now get further with less. Make sure capital is your primary growth constraint before raising your seed round.

5. The path to Series A

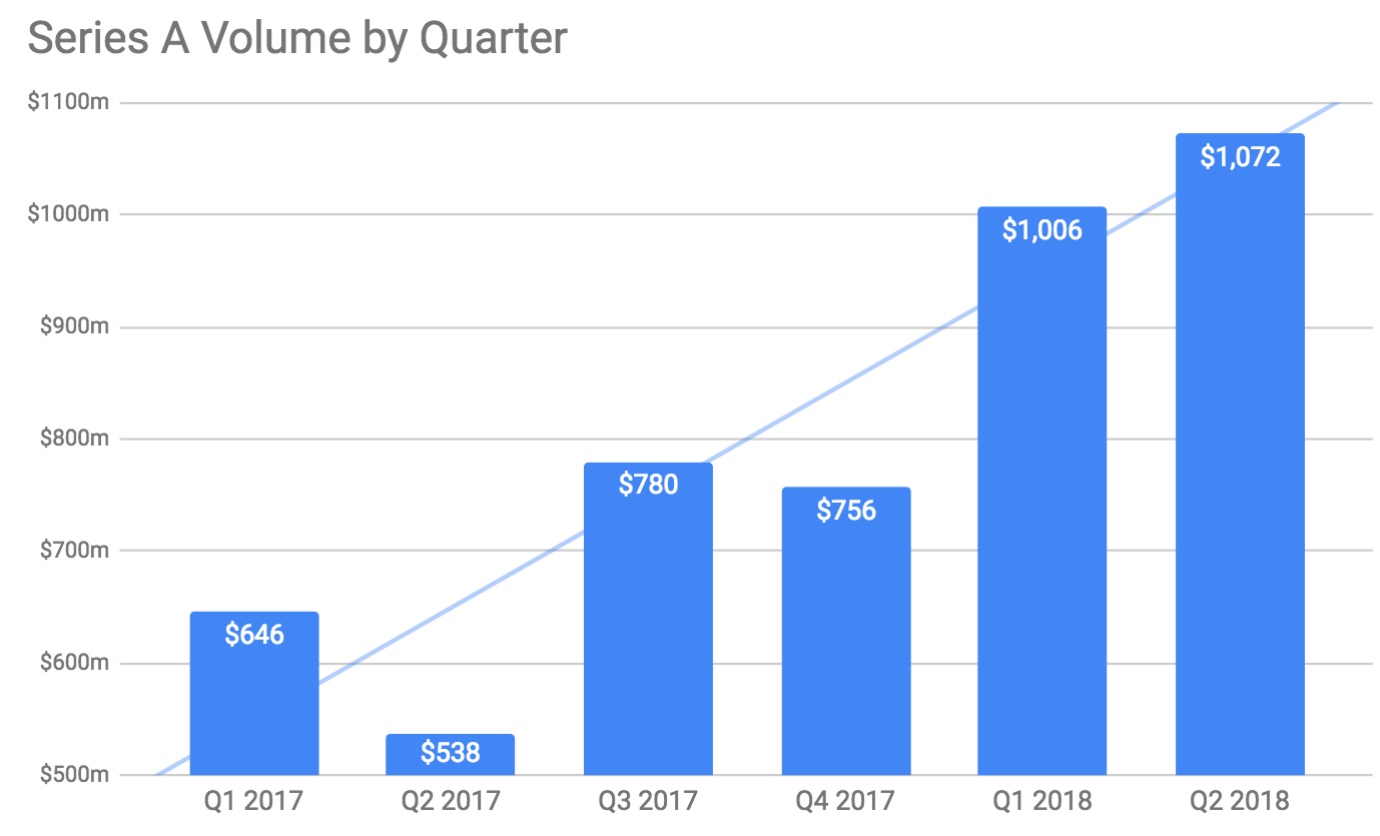

Series A funding continues to grow, with investor expectations of startup traction growing too.

Whilst there’s clearly been a steady increase in seed fundings, one of the expected questions for any seed-stage entrepreneur is: How do we get to Series A?

Looking at startup KPIs and revenue expectations might be overbearing for this analysis, so let’s look at the pace of Series A funding in the last 18 months as a proxy:

European Series A volume has been increasing markedly — without going into an analysis of ‘A’ rounds, we can deduce that the environment for raising is healthly at least.

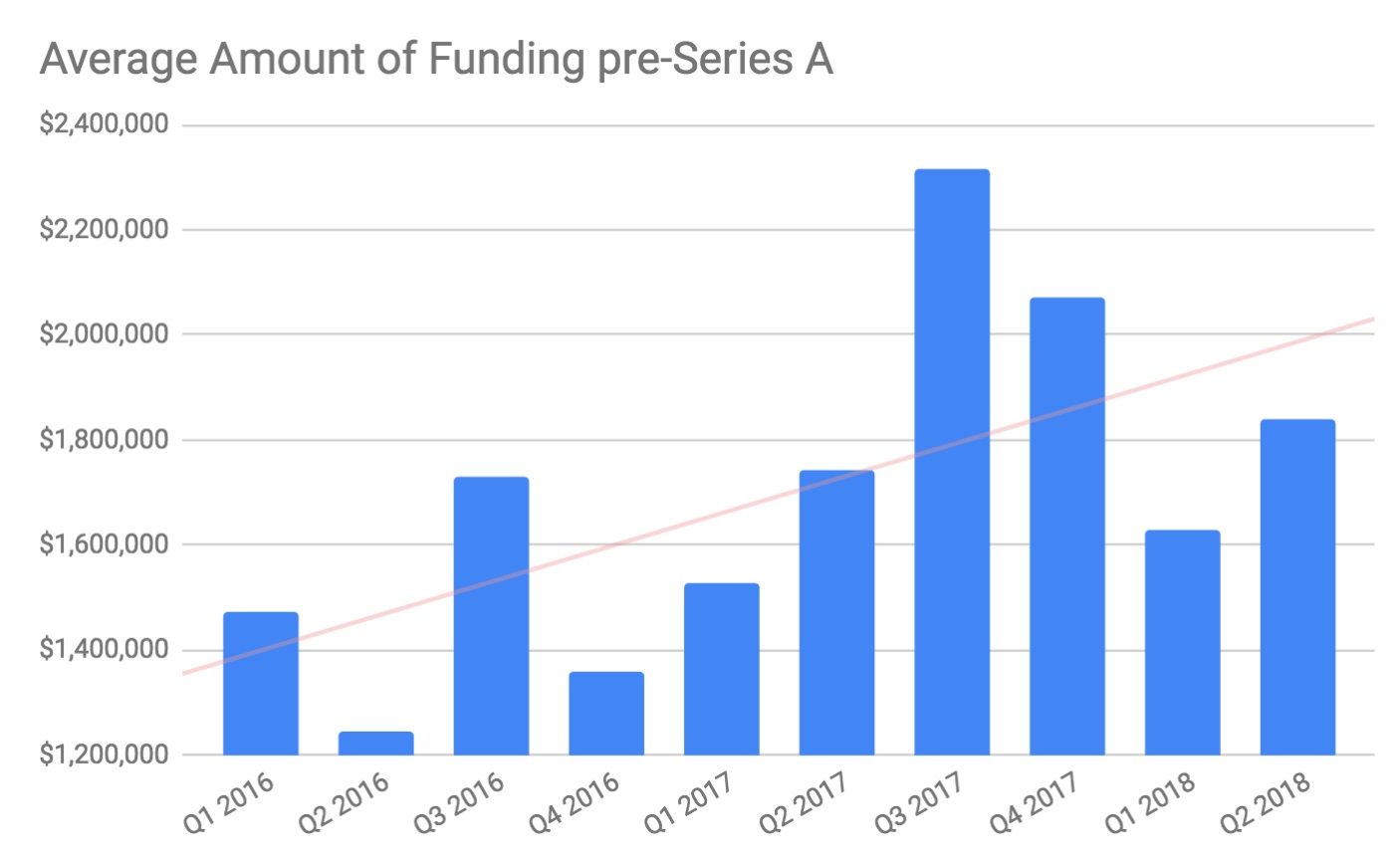

Let’s now look at the average amount of capital startups have raised prior to their Series A round. I would take this chart with a pinch of salt. All startups are unique and have their own capital requirements (hardware = high, software = low) to get to their next inflection point. The below is informational, not a goal or requirement.

Interestingly, the above chart, when contrasted with seed round sizes, shows there is not an insignificant amount of capital being raised outside of the “traditional” seed round — this will be from angel, pre-seed, bridge, and seed extensions.

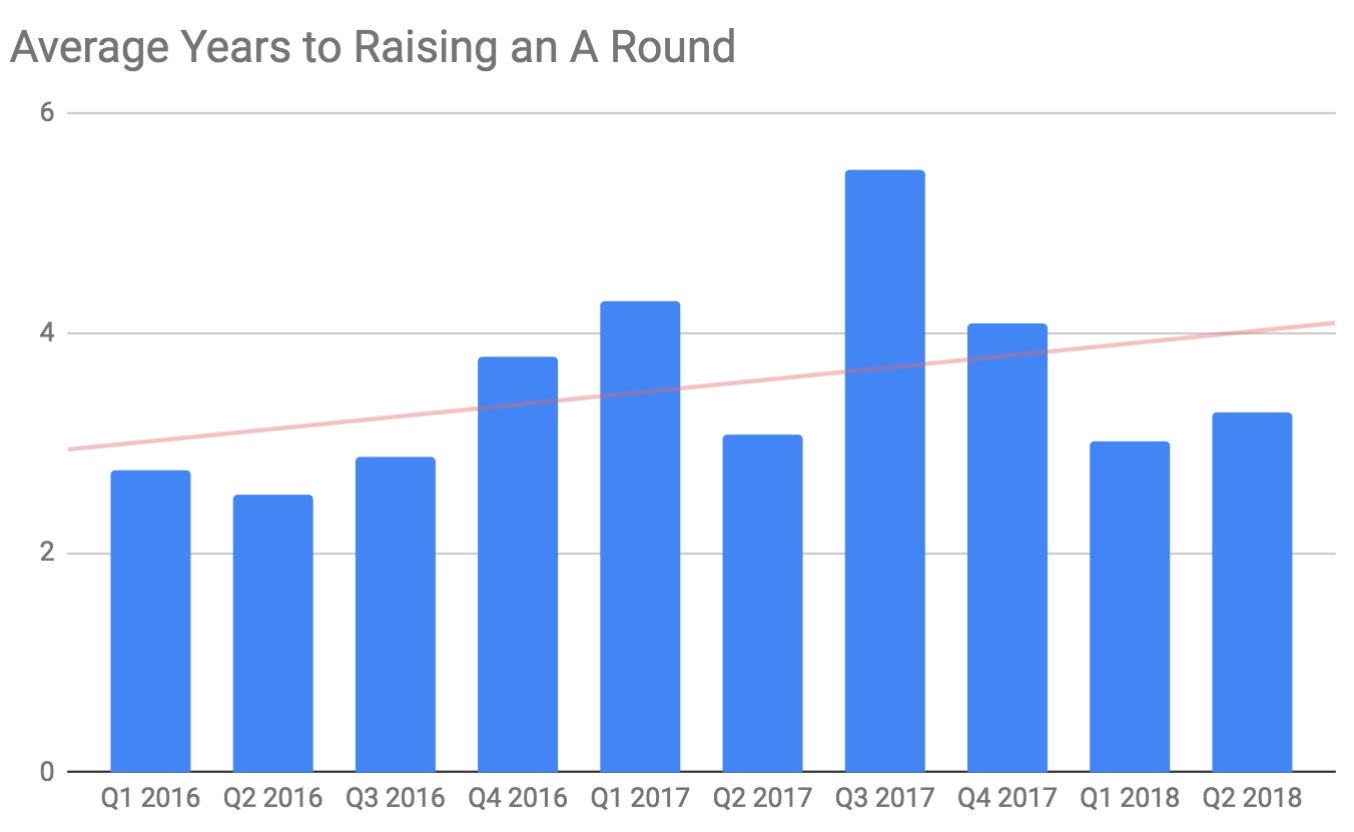

How long has it taken them to get there? Looking at a dataset of the last 2.5 years, it’s taken startups an average of four years to get to Series A.

Advice to founders: The trend line is clear. There’s never been a better time to start a company and raise early stage venture funding in Europe, although the time it takes to get to seed and Series A is increasing. Investor expectations of both seed and Series A startups have increased. Startups are also likely to have more runway to move from product-go-to-market-fit to product-market-fit to growth. A thoughtful and pragmatic approach to understanding the required KPIs to get to Series A is important. Startups through the seed phase will undoubtedly go through a multitude of hiccups and roadmap shifts in order to gather sufficient data points to get to product-market-fit. Positive directional progress (and cash) will keep your startup going, and the ability to work with investors who can provide a better understanding of the market requirements for an A round will give you an advantage versus peers.

The takeaways

Here are the key trends we’re seeing in Europe’s H1 2018 seed funding data:

- Europe is growing. This is self-evident. Europe saw nearly double the amount of IPOs than the US in 2016 and 2017 respectively. So far this year we’ve seen 27 IPOs totalling $32.5 billion in Europe vs. the 14 U.S. IPOs totaling $25 billion. Liquidity isn’t everything, but it helps bring in talent, fund repeat founders, increase investor returns, and bolster confidence, adding a new ring to the tree of Europe’s technology ecosystem.

- Seed is the new ‘A.’ This is not a trend that has emerged this year, but it is increasingly the status quo. Historically, pre-traction startups were considered seed . Now many investors are looking to derisk by writing larger cheques that are coupled to traction.

- Series A funds are moving into late seed. We’ve seen a marked increase in A funds doing larger and/or later seed rounds, blurring the lines between seed and ‘A’. This is happening for a multitude of reasons; a) seed companies are looking more like ‘A’ companies, b) competition in ‘A’ rounds is forcing some investors to write pre-emptive cheques as they look to get ahead of the competition, and c) many VCs have raised larger funds, forcing them to allocate dollars in and around ‘A.’

- Pre-seed has emerged. Pre-seed has broken out as a defined category in SV and NYC. Now we’re seeing a few dedicated funds, excluding incubators/accelerators, emerge in Europe as well as more seed funds looking to cut smaller cheques earlier. Founders would previously be required to either raise ‘friends and family,’ angel funds, or bootstrap their way to a seed round. We’re now seeing institutional investors take a deliberate step into this stage, capturing economics and often saving founders from the perils of building technical product on constrained budgets.

We’ve been hearing the repetitive rhetoric that ‘European tech is growing.’ And we can see now that the underlying data fundamentally backs up this claim.