Venture capital and private equity investments are outperforming the S&P 500, according to Steve Kaplan, an economist from the University of Chicago. Kaplan recently did a study to measure returns on the two asset classes compared to the S&P 500 over 10 years (2003–2013).

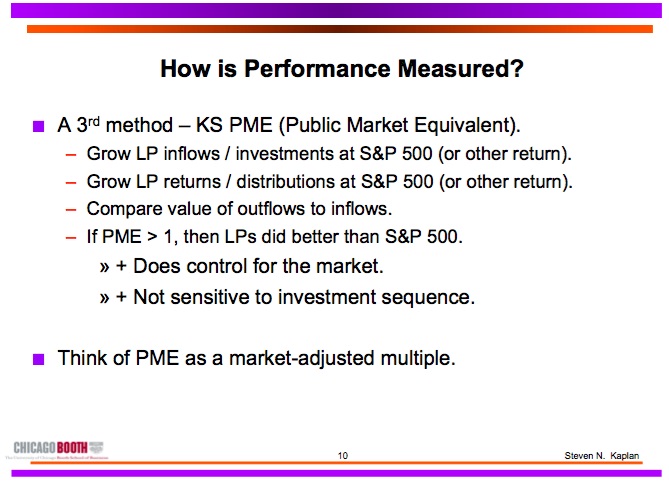

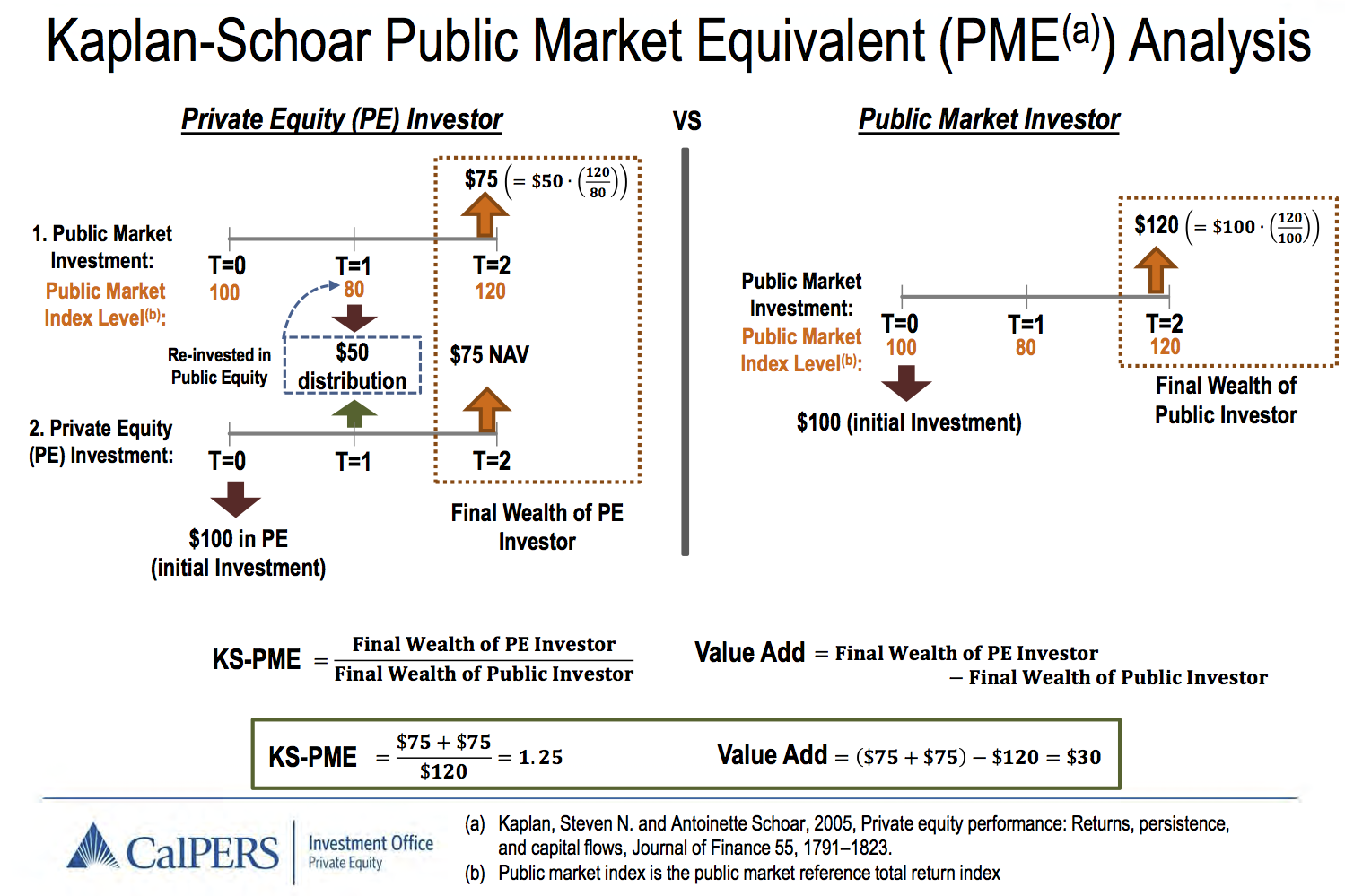

Common methods for measuring fund performance are Annualized IRR and Multiple of Invested Capital (MOIC), both of which have their drawbacks since they don’t control for market movements. So Kaplan and MIT economist Antoinette Schoar designed a method called the Kaplan Schoar Public Market Equivalent, aka KS-PME). The KS-PME is more of a market-adjusted multiple so you can understand how the funds are doing compared to S&P 500.

So how have the VC funds performed?

IRRs, Multiples, and PMEs vary substantially across vintage years.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

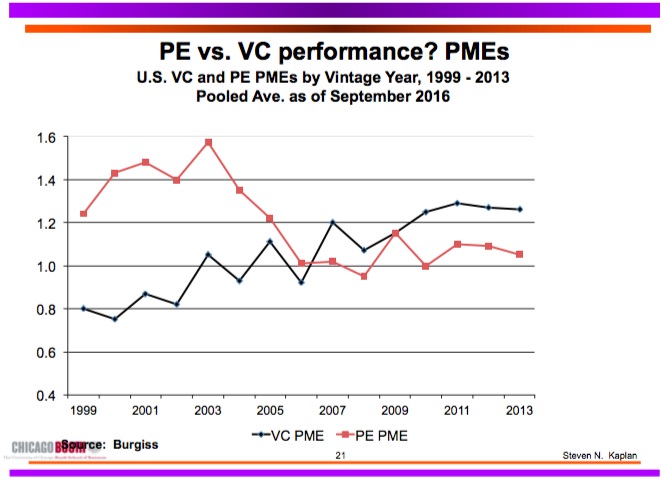

- PMEs performed well above 1.0 through 1998.

- PMEs performed below 1.0 from 1999 to 2002.

- PMEs have performed above 1.0 since 2003.

In fact, the data shows that VC funds outperformed the S&P 500 from 2003–2013 by 3–4 percent every year.

And how has PE done relative to VC in the same 10 years?

- From 1999 to 2005, PE did much better than VC.

- For post-2006 vintages, VC has done better.

Why? Hasn’t PE done better than VC in recent years?

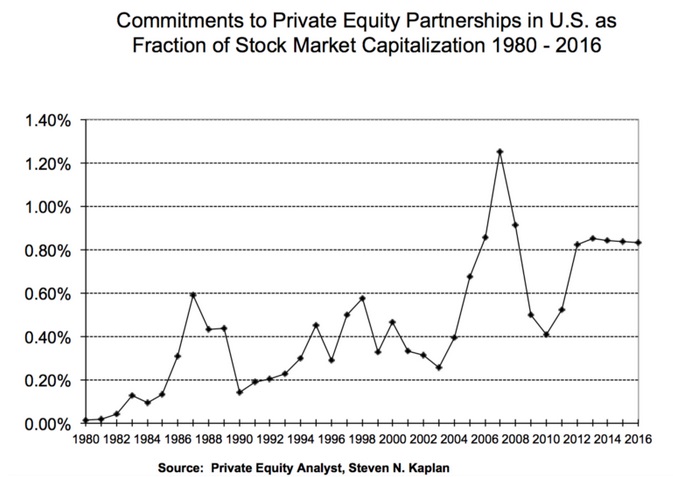

The answer is that performance in VC and PE is significantly negatively related to fundraising.

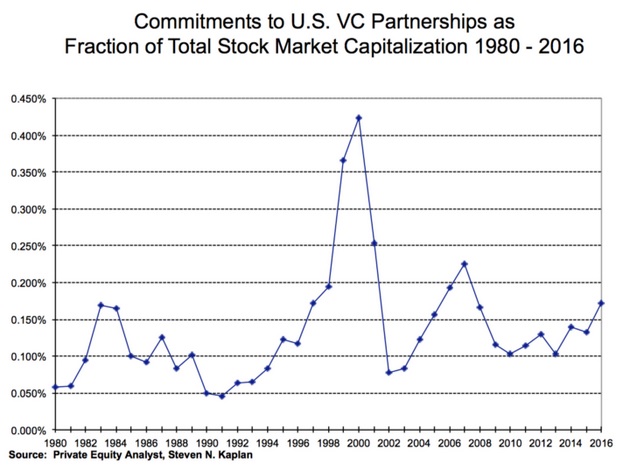

While VC fundraising activity increased in 2016 but not to crazy levels like in 1999–2000, PE activity has been close to all-time highs for the last five years, so relatively more capital has gone into PE than into VC, which might explain the large deals sizes and high valuations in the later stages.

Going forward how is the outlook for VC funds?

Here are the conclusions from Kaplan:

- Despite all the attention on VCs in the startup scene, VC’s commitments to stock market value are not particularly high relative to historical means.

- VC commitments were higher in 2016 but still nowhere near tech boom levels.

- Commitments to PE are at historically high levels. With the extra money, returns should be lower but not in the danger zone we were in from 1998 to 2001, and not so bad as 2006 and 2007.

- Accordingly, Kaplan feels better about VC than about PE and expects VC to beat the S&P 500 for the foreseeable future.

Thanks to Steve Kaplan for helping me put this article together and letting me use his findings. Here is the complete presentation.

PS : KS-PME is being used by the likes of Calpers to measure fund performance:

Shruti Gandhi is a managing partner at Array Ventures investing in deep tech verticals such as AI/ML, big data, security, and AR founded by “agitated” entrepreneurs that are working hard to reinvent enterprise solutions. She was previously with True Ventures, Samsung’s Early Stage Investment Fund and had three successful exits. Follow her on Twitter @atShruti.