Yesterday, Capital Factory CEO Joshua Baer announced a partnership with The Dallas Entrepreneur Center to bring Texas’ biggest accelerator to Dallas. In his post, The Texas Startup Manifesto, Baer proposed a “Texas startup Megatropolis” combining Austin, Dallas, Houston, and San Antonio.

The vision is exciting and highlights many of Texas’ obvious strengths:

- Growing at a rapid pace

- A low cost of living

- Diverse both in people and jobs

- Full of business and tech talent

- Home to great universities

- An energy and healthcare hub

It also highlighted many of the weaknesses:

- Underfunded

- Competitive, not collaborative

- Lack of mentorship

The combination of Capital Factory and the DEC will begin to address these issues and increase the diameter of the Texas ecosystem flywheel. But to take advantage of the work done by Joshua and his partners, we’ll need do to even more to make sure the larger flywheel gets the momentum it needs to keep accelerating at an even faster pace.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

We still need a few key ingredients in order to make our ecosystem comparable to the best.

- Operators that have scaled AND exited

- Density fueled network effects

- Follow-on capital

My favorite pieces of reading are those that say a lot without saying much. It’s a skill of which I am always envious and explains my addiction to Twitter. Last night, I came across one such tweet:

The more time I spend in startups, the more I’m impressed by those who scale than those who start. Many can start, few can scale. @mosbacher

My partner Jonathan recently wrote about the 80/20 problem being more right-skewed than perceived, specifically in startups. (I.e. the difference between great and exceptional is bigger than the one between good and great) CB Insights recently published a report using a cohort of 1,098 companies who raised seed capital from 2008-2010 that illustrates his point. The funnel below puts into perspective the increasing difficultly of each subsequent round.

According to Crunchbase, 184 companies headquartered in Texas raised seed funding last year. Let’s round to 200 for easy math. Using the successful exit criteria above ($50M+), 8% of companies exit for a desirable valuation. That leaves Texas with potentially 16 companies from a cohort of seed rounds in 2016 that have operators with both scale and exit experience. Assume each company has 5-10 rockstar employees (potentially more for the companies that truly scale rapidly) that experienced the entire company lifecycle and we’re left with 80-160 people.

In order to reach our full potential at the fastest pace possible, we need those operators to start, fund or mentor companies. This will create an exponentially increasing pool of talent to help new founders scale. For new companies, the chances of success increase when it’s not your first time down the road. To paraphrase Michael Seibel, partner at Y-Combinator, it’s easier to climb on the shoulders of others to get ahead.

Another point to consider is the density of the nodes (Dallas, Austin, Houston, SA) in the network. Texas has the distinct advantage of having several major cities within a 3-5 hour drive or 45min flight from each other, but what happens inside of those cities will be just as important.

The effects of startup density are obvious. When talented people who share a passion for startups interact on a regular basis it’s more likely that successful companies will be founded. The Kaufman Foundation defines density as:

entrepreneurial density = (# entrepreneurs + # people working for startups or high growth companies) / adult population

Since that number is almost impossible to easily obtain, Brad Feld asked the team at CityLab to use another indicator of density, deals per capita (100,000 people). I pulled similar data from Crunchbase using findings from 2016.

Unsurprisingly, the cities & metros you’d expect rank well with this metric, but a a few of the top cities may surprise you. College towns Boulder, Ann Arbor, and Austin are more dense with startups than cities like Chicago, LA, and NYC.

| City | Deals | Per 100,000 |

|---|---|---|

| San Francisco | 616 | 71.2 |

| NYC | 521 | 6.1 |

| Boston | 113 | 16.8 |

| Seattle | 704 | 14.6 |

| Chicago | 105 | 3.9 |

| LA | 136 | 3.4 |

| Ann Arbor | 13 | 10.8 |

| Boulder | 37 | 34.2 |

| Austin | 96 | 10.1 |

| Dallas | 33 | 2.5 |

| Houston | 33 | 1.4 |

| San Antonio | 8 | .5 |

While this data is certainly not perfect, (# of deals can be skewed by the fastest growing companies raising more than one round annually and Crunchbase only let’s you search by cities, not zip or metro) it illustrates the work Texas cities have left to do to achieve a saturation close to other metros and perhaps further illuminates the need for more venture funding in Texas.

Lastly, Texas is sorely missing the big checks. While seed stage investors from outside of Texas are beginning to invest more in the state, the evidence is still clear the follow-on capital is hard to come by.

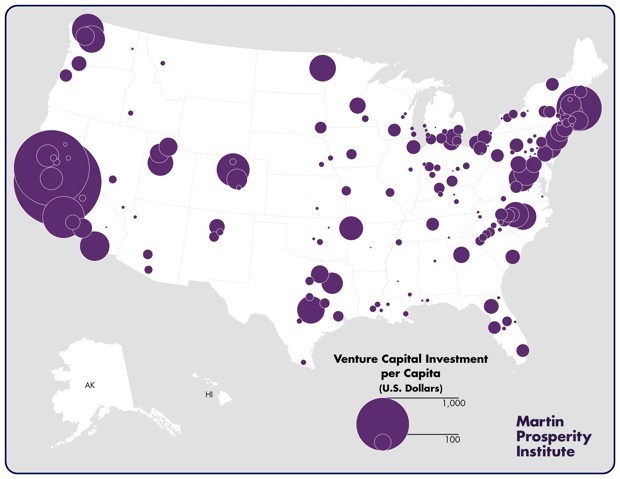

This map by the Martin Prosperity Institute shows the per capita investment of venture dollars. Austin is the only city in Texas to find it’s way into the top 20 at $252.

To be seen as an ecosystem ripe for more institutional follow-on investment we must inject more risk-tolerant capital into promising seed-stage companies to increase total deal flow and subsequently support them with the talent and resources needed to scale. These steps will increase the number of rapidly growing startups and make Texas more attractive to those who deploy growth-stage capital.

Overall, the partnership announcement is a huge win for the Texas entrepreneurs. The ingredients are here for a vibrant and successful startup landscape. However, we have to take this momentum and run with it to reach our full potential as an ecosystem.

Kevin Stevens is a partner at Intelis Capital, an early-stage VC firm based in Dallas. This post first appeared on his blog.