Lively, which provides a digital platform to help users more easily manage health savings accounts (HSAs), announced today that it has secured a $4.2 million seed round. Investors include Streamlined Ventures, Transmedia Capital, Y Combinator, SV Angel, PJC, The Durant Company (Kevin Durant and Rich Kleiman), Liquid 2 Ventures, Haystack Partners, and other angel investors.

The San Francisco-based startup launched its platform in March after graduating from Y Combinator’s Winter 2017 batch. Lively helps employees better manage their HSAs by consolidating all the administrative and financial information onto one platform.

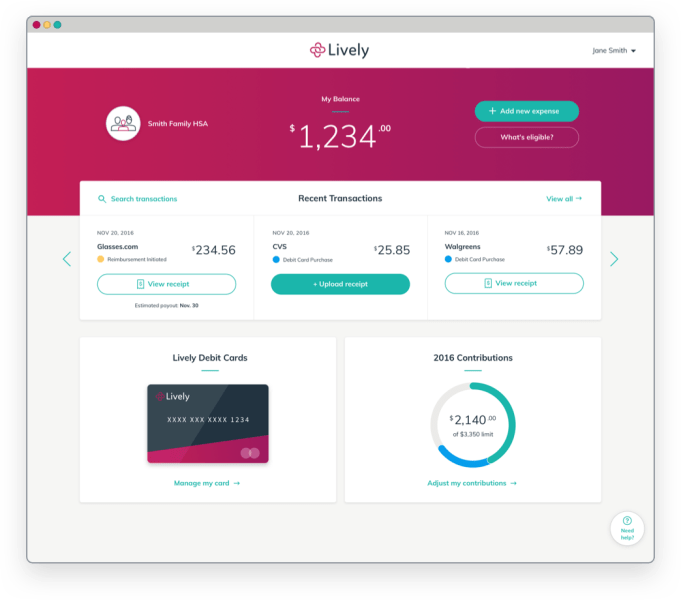

Above: Example of an individual’s Lively dashboard

While the goal of HSAs is to allow Americans to save tax-free money for their out-of-pocket medical expenses, Lively cofounder and CEO Alex Cyriac argues that HSAs can also offer the flexibility to save for health costs over the long-term, well into retirement.

“HSAs were not designed to be used as retirement vehicles, but they actually provide more tax benefits than a traditional retirement vehicle, like a 401k or IRA, and require no mandatory distributions, so you can save well into your 70s, 80s, and 90s,” he wrote in an email to VentureBeat.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

There are two aspects that make a health plan HSA-eligible: For individuals, the first $1,300 must come out of pocket before insurance kicks in (copays, coinsurance, etc.). For families, that amount is $2,600. Also, the annual out-of-pocket maximum cannot be greater than $6,550 for individuals and $13,100 for families.

While Lively declined to comment on how many customers it has, Cyriac claims that the startup has been growing 50 percent month-over-month since its launch. “We expect the growth to quadruple as we enter open enrollment season (the time at which most employers renew their health insurance plans),” he wrote.

Lively charges businesses 4 dollars per enrolled employee, per month, with discounts at scale, and it is free for individuals. Cyriac views incumbents in the space, such as HealthEquity, Optum Bank, and HSA Bank, as direct competitors.

In addition to its funding announcement, Lively is also kicking off new investment capabilities for its customers through its partnership with TD Ameritrade. “We were getting a lot of feedback from our users about wanting more options when it comes to investments,” wrote Cyriac.

In fact, the startup launched a self-directed brokerage option through TD Ameritrade to enable customers to invest their HSA funds by leveraging a variety of investment options, including individual stocks, bonds, CDs, ETFs, and mutual funds. “Simply put, users can invest in what they want,” he explained.

If users choose to invest their HSA funds, Lively charges them a flat fee of $2.50 per month. Since investments carry risk, Lively recommends potential investors consult with an investment or financial professional before doing so.

The startup will use today’s cash injection to grow its team of eight and continue its integrations with payroll providers, HRIS systems, and BenAdmin platforms.

While the HSA was introduced into law back in late 2003 under the Bush administration and continued growing under the Obama administration, the Trump administration could take things in a new direction.

“It’s no secret that the Republicans are doing what they can to repeal the Affordable Care Act,” wrote Cyriac. “They have introduced six or seven bills to Congress as far as a potential replacement, and every single one of them has an expansion of HSAs, which is obviously great for our business, if it indeed happens.”