Social casino games have become a $4.2 billion business, and Israel-based Playtika has about a quarter of the market. The company, which was acquired last year by a Chinese consortium for $4.4 billion, generated an estimated $306 million in the most recent quarter, up 26 percent from a year ago, according to market researcher Eilers & Krejcik.

And a big part of that revenue comes from the World Series of Poker, a web and mobile game that is based on the popular TV show series. The game has a big brand name, but Playtika has been growing the property on an annual basis, thanks to a combination of aggressive user acquisition, live operations such as new kinds of tournaments, and big efforts to retain players. Those tactics have made the game into the “Candy Crush Saga of poker.”

I visited Playtika’s World Series of Poker office in Montreal last week during the MIGS 2017 game conference. The office, which is home to more than 100 employees, was on the top floor of a skyscraper with a view of all of the snow-covered buildings and streets in downtown. I interviewed Jeet Niyogi, marketing director for the World Series of Poker at Playtika, and Yoav Ecker, general manager of World Series of Poker and Playtika Canada in Montreal.

Here’s an edited transcript of our talks.

Above: Yoav Ecker is general manager of World Series of Poker and Playtika Canada in Montreal.

GamesBeat: Do you remember when World Series of Poker started?

Jeet Niyogi: We were about 40 to 45 people at Electronic Arts, EA Mobile. Frank Gibeau was in charge. It was established over a few years. We launched in 2013. We were acquired by Caesar’s Interactive.

GamesBeat: Was it always only a mobile franchise?

Niyogi: Yes. The mobile product was launched first, and that’s where the emphasis was. Then we launched the Facebook game a couple of months later, but the mobile launch was the first launch.

In mid-2013 the sale happened, of the EA group, 19 people. The initial first few months was around building and stabilizing the product. The new product was launched at the end of 2013, the completely new World Series of Poker as we know it today.

GamesBeat: Was Playtika already big in social casino at the time?

Niyogi: Yes, Playtika had Slotomania and Caesar’s Slots around the same time. Bingo Blitz was an acquisition that happened in 2011 or 2012. They had a few big games. This was the third or fourth big acquisition. House of Fun came later, after us. Those were the big five in the top 100 grossing overall — not just games, but overall: Slotomania, World Series of Poker, House of Fun, Caesar’s Slots, and Bingo Blitz.

GamesBeat: And it stayed in the rankings all that time. What do you think explains why it stood out, among all the casino games and all the poker games?

Niyogi: Slotomania launched in 2010-2011. The famous story goes that everyone in Israel laughed, because who would play slots just for fun? But the mechanics and the content were key differentiators. The nimbleness of the team, to provide a good content update every two or three weeks, was a great retention element, a great differentiator in the industry. That had never been done in slots. Zynga Poker had established itself in the poker industry. But the first mover advantage was there, plus the innovative content production. That’s what the audience came for, and then followed by good retention and monetization practices. That helped our business grow.

Moving on to World Series of Poker, that was a well-known brand in North America, but I’d say that now our mobile game is a bigger brand than the actual World Series of Poker tournament, globally and in North America. So it had the brand, but I think there are three or four things that made a huge difference. First of all, we innovated with the product from the start. A lot of focus went into the first launch, but that stayed subsequently. We stuck to giving a very good, authentic poker game, married with the brand equity we already had. But we also put in place a lot of innovative features over the years — things like the Texas Roulette event, where you can simply go all in or fold, without the intermediary steps any other poker game has. That worked really well.

Above: Playtika’s Montreal office is in a skyscraper.

Live operations is a key. But even before live operations becomes acquisition and marketing. We focused very much on relevance, not just throwing money out the door. Profitability was always, as in other Playtika games, a key measure. Coming in from EA, I was making heavy requests for investment, but we worked in a very sustainable fashion. Smart data-driven user acquisition. Live operations to bring people back.

We focus heavy on our D2 (day two retention of players), D7, D30, and even in some cases D360. We see what our annual retention is like for people we bring in. Playtika has obviously mastered monetization as well as retention. We benefited from those practices and learned a lot from the other guys, the Slotomania and Bingo Blitz teams. We reproduced those for the poker world.

The combination of all these facts—we’re still a small, nimble team. It’s not super large, only 119 people. Back then, everything was all in one studio – publishing, marketing, development. We were just the developers. I was the product marketing guy, and the UA team sat somewhere else. Having everyone under one roof and being able to work fast—we were making mistakes, still. Zynga Poker was our big competition, just to break even. When we started, we were in the 80s or 90s overall, or even lower. The few days we were ahead of Zynga Poker, we were very happy. But the product innovation worked, and making a very authentic poker product.

GamesBeat: Was Montreal an unusual place to do this? Or did it make sense in some way to keep the developers here?

Niyogi: We have good developers. Poker wasn’t something we innovated. [laughs] Everyone’s played poker. EA put the studio together because it already had a Montreal studio, and got some good breaks to set up here. There’s a very solid talent base. That helped. I think this is the fifth-largest gaming hub, something like that. Those things mattered. And then we grew. Some people have come from our HQ in Israel, of course. Those elements also help.

If I had to break it down to three points: smart decision-making, very data-driven decision-making, looking at profitability and marketing spend closely and bringing in relevant users. Product innovation. We launched bracelets, which was a huge success. The World Series of Poker awards bracelets, right? No one else can award real WSOP bracelets, so we did that and it was a big hit. And then innovations like Texas Roulette.

We did Poker Recall recently, which was very successful. It was a game where, every time you play a certain number of hands, everyone gets a pack with three cards. There’s a board of 20 cards you have to fill every time you get a card, and then you can make hands with those. It’s like a recall or memory game with poker skill. The higher the hand, the higher the payout. That was another innovation. So I’d put it down to active marketing and product innovation.

GamesBeat: But you guys came after Zynga Poker and started climbing the charts.

Niyogi: We grew at a very rapid pace. I believe by the end of 2014 or early 2015 we overtook them in the U.S., first on iOS and then on Google Play. In some countries they’re still stronger than us overall. I would say Germany, but they localized their game. Our game, we market it in a local way, but the game itself is not localized yet.

GamesBeat: As far as opportunities along the way, Zynga had a bad transition from the old poker to the new poker. They lost market share.

Niyogi: Yeah, that was 2014. It happened at a time when we were really scaling our operations up. We were on the rise. But regardless, we were focused on giving true poker players a very authentic experience. One more thing that comes to mind is app store optimization. When you searched for “poker” back in the day we would be eighth or ninth. In 2014 and 2015 we hit six or seven, and now we’re one or two most of the time. That makes a huge difference. 60-65 percent of people who are interested in poker just go into the app store search and type “poker.”

Obviously Apple is monetizing that. They’ve started Apple search ads. But organically, we are number one. Zynga Poker is number two. The algorithm is based on a lot of factors — download velocity, engagement, product reviews, ratings, conversion, keywords that you put in — and we worked on those things, I would say more than many in the industry. Our UA team and our SO team are quite well-known in the industry.

Above: A snowy view of downtown Montreal from Playtika’s office.

GamesBeat: Is that still a pretty big part of why Playtika is the biggest social casino company?

Niyogi: Yes. Similar maps can be drawn for each game, like Slotomania. The slots space is a lot more competitive than our space. It has many more players, as you know. But continuous innovation, understanding what players want – researching, analyzing – and producing that. To be nimble and produce a slot machine every two or three weeks is really something. We’ve been able to do that successfully, introduce meta-games like Slot Cards and Slot Quest — quests and collectibles along the way have helped retain and monetize in a game like ours.

Playtika’s mantra has also been acquisition, and then taking it to the next level. We had the recent acquisition of Jelly Button, with Pirate Kings and Board Kings, two very solid games. They’re already doing well and they’ll go hire.

GamesBeat: What else has helped World Series of Poker?

Ecker: That helps a lot. On top of that we’re also investing quite a lot in AI. We have strong team here to help us with that. It underlies the live operations part. That’s one thing that gives us a strong competitive advantage. Competitors can’t necessarily know what’s standing behind that. This is something I think only big companies can address and do properly. To do it properly the data needs to be very clean, very deep, very wide. We’ve invested very heavily and are still investing in that.

GamesBeat: Why does it take more than 100 people to run this game? Is that the scale of the live operations?

Niyogi: Everything is done here. The people here are doing marketing, user acquisition, and business intelligence. Live operations is a huge team. Every day you’re producing at least one event. Then you have sales and promotions on top. Innovative events to keep them engaged almost every day, and then some sales promotion on top of that. There’s a huge product team doing UI and UX. That’s all here. There’s a client dev team, a server dev team. And then there’s the management of all these different groups. Everything is controlled here. We’re top 50 overall. I think yesterday we were 44 or 45.

GamesBeat: You can justify a big team with that kind of result.

Niyogi: Yeah, absolutely. Some companies don’t focus as much on profitability, given their IP and their huge acquisition costs. But there’s always a smarter way of doing acquisition, bringing in only the relevant people and not paying for people who are going to leave. Our game is a multiplayer game, so we need people to be there. A poker player won’t wait. They’re not interested in playing against a machine. We need sticky players. Not all of them need to pay. There’s a focus on non-payers, building a game that will attract people in general.

GamesBeat: It’s amazing that one game can fuel such a large operation here.

Ecker: That’s the approach. We’re looking at it differently from other companies. At other companies, they call it a project. A project has a beginning, a middle, and an end. You ship it and forget about it. Because we’re doing all the live operations behind the game, we’re actually keeping the product alive all the time.

When I came here, the game designers were game designers. Now we call them product managers. It first it just feels like semantics — this is a journalist, this is a reporter, this is a blogger. But eventually it’s more philosophical than that. As a game designer you design a game and you ship it. As a product manager you have your own product and you have to constantly evolve it more and more.

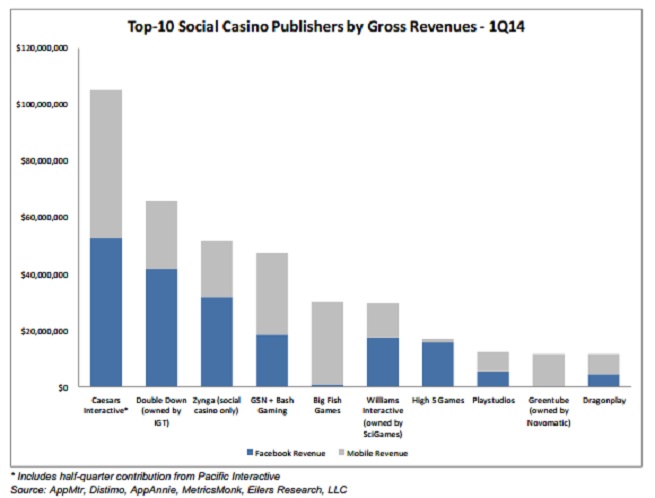

Above: Top 10 social casino publishers in Q1 2014

GamesBeat: Poker seems like a mature market in some ways.

Ecker: The poker market, at least for us, is a growing market. We’ve managed to grow significantly over the years, especially last year. The competition is currently mainly with Zynga. They’ve done very good work this year. I think we’ve done better, but they’ve done very well. I’m looking forward to 2018. It’s a very optimistic year for me. We believe we’ll be able to grow quite substantially.

Players are getting more and more sophisticated. The way they’re playing is much smarter. They’re becoming more professional. We have some very interesting things in store for our players next year, things we’re developing and working on.

It is mature, but there’s a lot of innovation behind it. Looking at the road map here for the next three to five years, we have some very innovative things in store. Even simple things like what we’ve done in the last couple of years, like when we introduced Texas Roulette. It seems like a poker game, but we changed something in it, just took one step in the middle out, and you come up with a very popular game that our players love. We introduced Powerhand Jackpots. We introduced Poker Recall, which is a memory game combined on top of that, which has done very well for us. There are a lot of factors working in the background that are turning out very well.

GamesBeat: Did anything change when Playtika was acquired?

Niyogi: No, nothing surprising. That was the expectation, as well. The Chinese consortium bought it as an investment. Robert Antokol and the team here and all the other studios know how to make and grow a poker game or a slot game. Under Robert’s leadership — he’s as hungry as ever. He was here a few months ago to pep us up, when we were launching Poker Recall.

The involvement from the other guys is more from a books perspective, investment. We have to grow. We have a very defined growth strategy. It’s arduous, uphill, but we’ve been keeping that higher than usual growth. We’ll continue to do that. It gets harder and harder once you’re a bigger game.

GamesBeat: Did you get some benefit from Playtika’s history, where Israel was a center for online gambling, and then it became a center for social casino games and marketing technology? You have all of that concentrated in Israel.

Niyogi: Absolutely. There’s a very close connection, although we’re over here. A lot of trips are made. A lot of intelligence and operational secrets are traded. Tactics and strategies are shared. In that way we’ve benefited. It’s not only technology.

We’re ideally located between hubs of development and marketing know-how. San Francisco isn’t far. We get all the exposure and experience on how to retain people and monetize people, how to make a good mobile game. That exists within Playtika. We’ve had huge strategy sessions. We have very good data modeling, whether it’s platforms, technology, or ways of looking at data. All that’s coming from Israel.

We have a lot of good product innovation. This meta-game was successful in Slotomania, so can we translate it into the poker world? From a product perspective, from a data perspective, the know-how on how to retain and monetize people, all of that stuff.

Above: Playtika bought World Series of Poker from Electronic Arts.

GamesBeat: Playtika in Montreal is kind of an oddball.

Ecker: I’ve seen a lot over the years I’ve been here in Montreal. It’s a great place for people to come and work. It’s evolved significantly. In the past, a few years ago, we had to convince employees to come here. They’d say, “Playtika who?” Now they’ve heard so many good things about us. Honestly, I think today Playtika is the best workplace in Montreal. You can see the offices, which I think are some of the nicest in Montreal. We have amazing people here. You can feel the energy in the office. It’s very positive. Everyone in the office feels they make an impact, regardless of where they are.

Part of the Israeli culture is we don’t have hierarchies. We have a very flat organization. Everyone here in the organization can come and talk to me as the GM. It’s strange for people who come from the Canadian culture, where there’s a lot of hierarchy. You talk to the boss, and then the boss of the boss of the boss, and then maybe you get to the GM. Here it’s very flat, very casual. Our retention rates are very high. We get a lot of people who just want to come and work for us, because they hear from their friends that it’s a good workplace.

GamesBeat: Social casino seems both mature and vibrant at the same time. You have newcomers like Huuuge, but you also have acquisitions going on like Aristocrat picking up Big Fish.

Ecker: It’s a natural thing for the market. It’s the hockey stick, right? When the market is very early there are a lot of small companies. When it starts to mature some of those companies become bigger. Then it becomes very mature and they buy the remaining smaller companies and shake things out. Eventually it’s a big player’s market.

If you look at social casino, five companies dominate more than 50 percent of the market. We have more than a quarter, just Playtika. In order to succeed you need to be big. You’ve probably heard this many times, but I think we have the right DNA, the right culture to succeed in social casino, and also in other games.

GamesBeat: Zynga’s boss Frank Gibeau might not be people that Zynga Poker is getting beaten by people who used to work for him.

Niyogi: [laughs] I know a couple of people at Zynga. They’ve talked about us as the one they let go. But at the time there was a different strategy. You had Scrabble, World Series of Poker, Yahtzee, and a couple of other games run out of that Montreal studio. They were streamlining. Things like that happen.

The flash in the pan growth — I don’t want to name names — these are all industry friends — but you know how some games appear for three weeks to three months and then they’re nowhere to be seen. But our story — I’ve worked closely on World Series of Poker for four or five years. It’s grown slow and steady, but steady.

To maintain steady growth you have to make smart decisions on the marketing side. Who are you bringing in the funnel? What are you paying? What’s your profitability? Don’t throw money away just to block other people from entering the space. Live operations is super critical. You have to engage people. It’s a cluttered world. We’re competing for time with many others, and if we don’t give them enough reason to come back, even if you bring in a quality player, they won’t come back. They have a lot of options.

You have to be smart about monetization. Something has to pay our bills. We don’t do any ads in our games. That’s a good experience for users. Users like that. But we have to grow as well. We have to balance that out. Maintaining sustainable growth is a recipe combining all these active elements. It gets harder, when you reach 45, 50, 26. We’ve been as high as 26 overall, and then slid down a little, but we’re constantly working and tweaking.

GamesBeat: How much of the work should be done in-house, versus using third-party user acquisition companies? They’ve gotten increasingly automated, more AI-driven, and much bigger.

Niyogi: It’s always a debate. There are no easy answers. But from my perspective, user acquisition has become about doing things more nimbly, getting the data metrics quicker, targeting properly. Targeting is a huge thing. Facebook and all those guys have given a lot. All of this requires creative resources. You need videos and other creative. Not every company, especially smaller companies, has the resources. It’s better to go and pay a certain percent of your budget to an agency, because the agency has expertise from working with other people.

But when you grow — this has been our strategy. I was using agencies four years ago when I was a one-man team. We brought in experts and hired experts to do things like Facebook campaigns and Google campaigns. When your company grows, it makes a lot of sense to do it yourself. Every penny you’re saving can be reinvested in acquiring users as opposed to paying an agency, if you have the right resources. A lot of small to mid-sized companies can use agencies, but gain the expertise in-house and slowly try to go 50-50 inside-outside, or go higher. Data is the most important thing we own. It’s good to keep that inside.

Above: Playtika logo

GamesBeat: When you have a team around this size, a top 50 game, are you most likely going to have an internal user acquisition team?

Niyogi: Yeah, an internal team. Our team just focuses on World Series of Poker. Again, people might defer, but I believe you need it. Even managing the networks, AppColony and all these other guys — there has to be the Facebook guy, the expert in managing Facebook campaigns, and the Google guy. You have to be on top of all these channels.

There are a lot of benefits, but you have to treat agencies like partners. The strategies you develop, they have to be good executors of those strategies. But if you can replace someone with a team internally, there’s nothing like it. Nothing gets outside. Tomorrow you might not work with that agency, but your competition does, and all the strategies are transferred or compromised.

Nothing against agencies — I love working with them — but creative is an excellent example. We don’t make all our videos internally. We can hire someone to make fancy videos for the app stores or UA. It’s a mix.

GamesBeat: Where do you get your best users from? Is it surprising in any way, where you find poker players?

Niyogi: Even the usuals, like Facebook, you don’t necessarily know what will work, when it will work. There are many competencies to it. Of course there’s where to find them, where to find high quality players. Facebook stands out for any industry, any genre, because they have advanced in their targeting mechanism. It’s not just about bidding high and having the best creative. The targeting component — instead of spending your money targeting a mass audience, the changes of higher conversion are better. That’s where Facebook has done well, and why it’s very relevant for all players.

They also continually innovate with products like app event optimization. I don’t know if you’ve heard about that. They can find people with a certain set of behaviors, a higher propensity to purchase, and marry those things. But as a general rule, we know our demographics, the better retainers and monetizers, and we try to target those demographics or behaviors. The networks also help.

It’s a matter of constant experimentation. We have to be on top of it. We can’t just put in $10,000 and forget about it. In the early days you’d look at it every two or three days. It was easier. Now, when you’re fighting the cost battle and get the most relevant users, you have to be looking at it every two or three hours. All of these platforms and tech and AI are only going to help the human managers find the right people at a decent price.

That’s the struggle on the UA side. But again, you’re making those data-driven decisions, using technology, using your BI team—there are BI people that help us analyze users and sources. There is no guaranteed source. One thing we know is that people who play other social casino games are usually good for us. We know some things like that. But there are surprises all the time.

GamesBeat: So people do come from the other games into poker?

Niyogi: Yeah. Like I say to my team, nothing should be left to intuition. We have enough data that we can make guided decisions. In the mobile world that’s a huge advantage over the Madison Avenue days, the billboard days.

GamesBeat: What do you think about this broader feeling, that monetization and user acquisition people aren’t really welcomed by game developers?

Niyogi: True, true. Absolutely. The gap was even wider in the core gaming space. I would think the mobile world, the Facebook world, have brought those factions a bit closer. Many people have spoken on this and there’s a constant discussion. What you think is an amazing game, a game you spent years making — if it’s not worth anything, it’s going to die. Your great work won’t be adopted without enough marketing.

I’m not just talking about dollars. You do smart marketing. You do influencers. You do many things these days to reach out to people. PR is part of it. But I believe strongly in performance marketing. Even if you just have $10,000 or $1,000, put it into something you can measure, instead of just putting an ad on TV. You have ways to measure that, but not as directly as you do with Facebook or Google ads.

Above: Playtika’s World Series of Poker.

GamesBeat: So the argument is that this industry wouldn’t be as big. It wouldn’t have as much independence. It wouldn’t have as much variety, all the different apps out there, if this free-to-play thing didn’t work.

Niyogi: No, absolutely. There are 2 million apps in the app stores. There’s not so much clutter in the console space. You have a lot of PR and other engines at work.

Another reason UA and monetization people aren’t such good friends with developers — every time we ask them to create an SDK that would bring us better users or track better users or monetize some of these users — they’re focused on making a great game. It’s an important discussion. But what Playtika also does differently is it’s very transparent. Sharing everything, from data to revenues, is done in a very clear fashion so people understand.

If the developers have skin in the game — that’s what’s changing with many startups, right? Stakes and stocks and whatnot. Everyone benefits from a good acquisition team or monetization team. That’s been lacking in many of these amazing game developers. All of the successful games in the top 100 today — some of them are better games. It’s a subjective thing. What you consider a better game, I might not have much fun with it. But they’re all excellent games, and there are many other excellent games in the 100-500 space. What takes a game from 250 or 300 into the top 50 is making those smart marketing decisions and putting out content that’s relevant.

There’s always this argument. “I don’t think this event should be pushed out now. We don’t like it from a product development standpoint. It’s not necessary.” But now you can showcase the data. The event launched from the 13th to the 16th and this is what it did for the game that benefits you. These are the KPIs. Playtika has done that very well. Everyone has skin in the game.

GamesBeat: As far as predicting where some of this is going, where user acquisition is going, is this working fine? Does AI have a bigger impact in the future?

Niyogi: We’ve discussed this a lot, myself and my UA peers from different companies. I believe AI is going to help the current UA manager. Cost is going in only one direction. Our hands are tied, especially with mature games. More people know about your game, so it’s harder to find relevant people. A lot of it falls into analyzing the data and predicting where to find the high-value players.

The predictive modeling part is where AI and deep learning can help. The propensity to pay — how can you find that based on the early behavior of an individual? How can you map out their propensity to play more or pay more? That’s the realm of deep learning and AI. That’s the right direction. The people who are using it smartly — some folks are developing it in-house. The top 15 or 20 that you see on the overall, probably everyone is either working with a third party or developing internally, scoring users and trying to predict where the next high-quality user is. It’ll be very important.

Above: Playtika’s World Series of Poker

GamesBeat: It helps that it’s considered casual?

Niyogi: Right, it’s not super serious. No one is losing their shirt. The majority of people aren’t paying at all, more than 90 percent. They play for free, and for years, in all of our games. We’re not even monetizing them with ads. They’re completely free. But certainly there’s a certain percentage that come to our game and play a lot. I would say the whole free-to-play, freemium mobile gaming business is drawn up like that.

GamesBeat: Do you have any wisdom about how to deal with whales or how to treat whales in a game?

Niyogi: Well, first of all I don’t like to call them “whales.” [laughs] Of course, high-quality players have to be treated — first you have to identify how to find them. There’s no secret recipe. Everyone is trying to do that. That’s why we all need to analyze and monitor constantly, to use predictive analysis of where our high-quality users come from. But as I said, not everyone is a payer. Everyone who plays contributes to the game.

We want people to come and play our game. Make the product that will make people come and play. Then the mechanisms of where they sit, which tier they fall in, are secondary. It’s important, but the primary fact is we have to make a game that people love and come back to. Not just love for one day, for a few days, but for months. Then, once they come in, you have to treat everyone well.

GamesBeat: Is it like a real-world casino, where if you spend a lot of money, if you’re a high roller, you end up with VIP privileges?

Niyogi: I don’t think there’s anything like that. You’d have to play our game to understand. You have to treat your players right. That’s the core of everything. We have an extensive customer service team, which isn’t just taking questions from VIPs and ignoring the guys who aren’t paying. As I said, we want people to come in. We want the user base to grow. Any game that’s dependent on just a handful of whales, or whatever you call them, is not a good game in our terminology. It’s not a sustainable model.

Above: Playtika’s office in Montreal.

GamesBeat: How has poker’s visibility helped over the years? It’s gone through cycles, I think, the popularity of the game.

Niyogi: It certainly has gone through cycles, some more favorable than others. Right now it’s in a good place. Poker is still probably — because it has that skill element, that element of when to do what, some math involved, a lot of skill required to win — it has some friction for super-mass adoption. I don’t think there will ever be 5 billion people play. More people play slots. But we’re trying to expand and spread the word.

Before, in the mobile space, Zynga Poker was the only player. Now World Series of Poker and Zynga Poker are equally important players. That helped move the poker industry. I’m 100 percent sure we converted a lot of non-poker players into poker players. We’re not just stealing from each other. Also, many players play more than one game.

GamesBeat: And you have the benefit of the TV brand.

Niyogi: Right, we have the benefit of the tournament. That’s been going well. It’s broadcast on ESPN in North America, and it’s spreading into Europe. In Europe PokerStars is a huge brand. That helps boost the poker brand overall. We’re in a good cycle now. I think we’ve contributed — not just the World Series of Poker brand on TV, but our game. We’ve converted a lot of people to poker. But absolutely, there is seasonality tied to the tournaments. During the main event, for example, a lot of people are looking for poker. I’m sure Zynga Poker and our game both capitalize on that.

Asia is always a tougher market to crack, because they have their own poker and other games. China, Japan, and Korea have different regulations in place. But that’s the next frontier to conquer.

Disclosure: The organizers of MIGS 2017 paid my way to Montreal. Our coverage remains objective.