2014 saw more investment than ever in the marketing technology space, despite a dramatic slowdown in funding during the last quarter.

Analyzing over 1,100 companies using data from VB Profiles (disclosure: VB has a stake in VB Profiles), which aggregates company data from marketing technology lists from organizations such as VB Insight, ChiefMartec.com, Gartner, and LUMA Partners, investments in the final quarter of 2014 were almost 60 percent lower than in previous periods. Despite the last quarter lull, martech continues to be a red hot investment space.

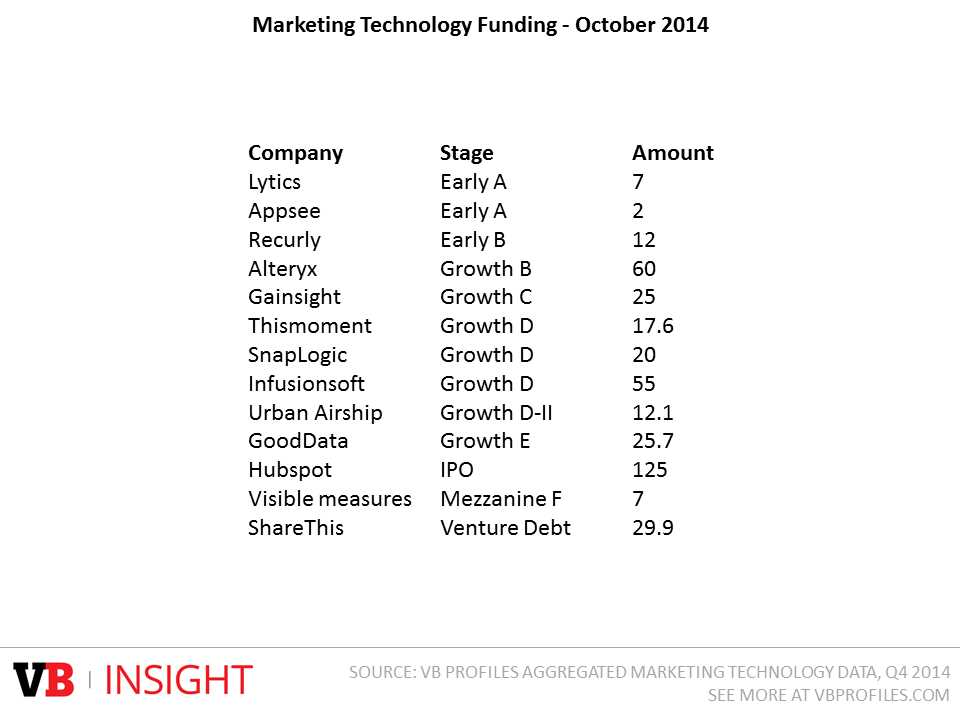

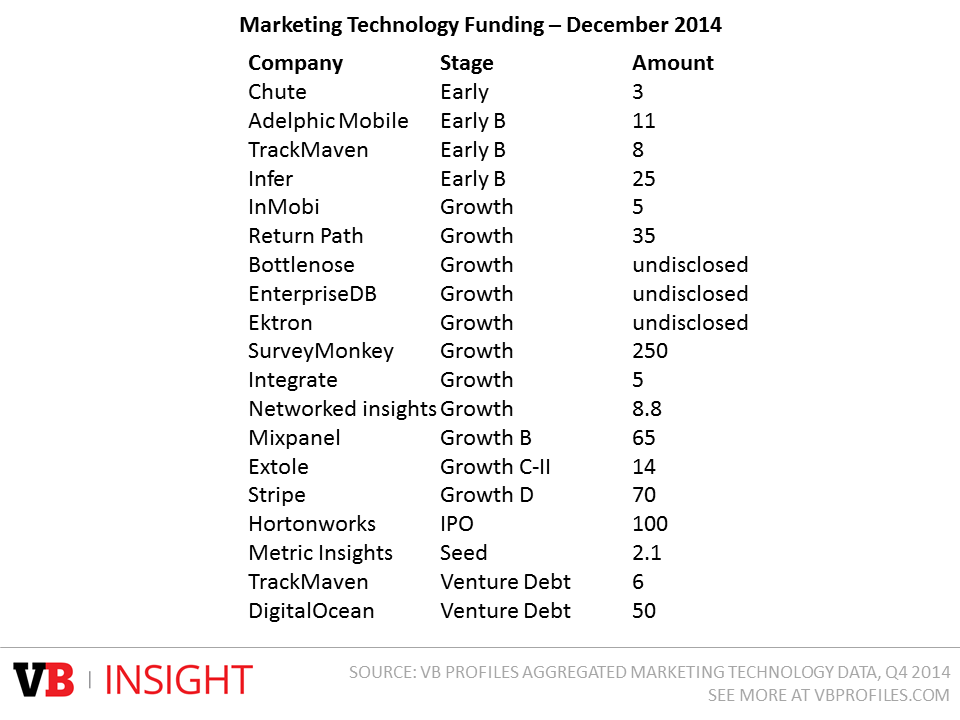

One of the big winners in the final three months of the year was SurveyMonkey, a poll, survey, and questionnaire company. SurveyMonkey raised an additional $250 million in December to take its total funding beyond $1 billion. Thanks to an IPO in October, Hubspot raised $125 million to help it grow in the inbound marketing industry. Other big winners included Hortonworks, Stripe, Mixpanel, Alteryx, and InfusionSoft.

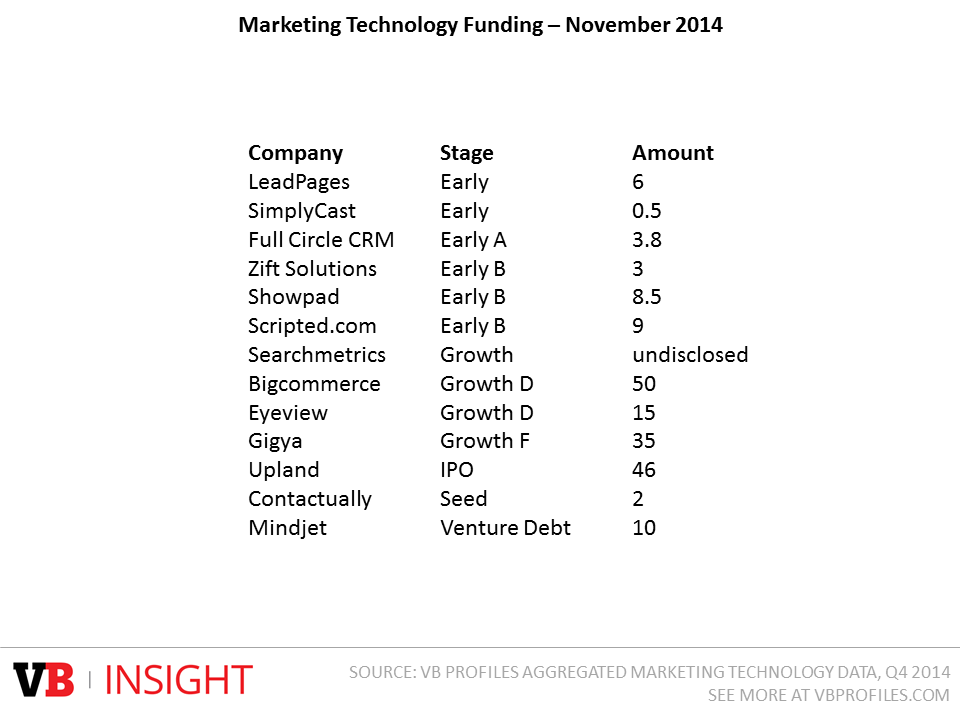

In total, the final quarter of 2014 included 45 IPO, seed, early stage, and growth events, totaling over $1.24 billion.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

So just how hot is the marketing technology industry right now?

VentureBeat is studying the entire CRO space.

Answer our survey now and we’ll share the results with you.

In 2014, $11.4 billion was raised in total across 246 organizations, and that takes into account only those that raised funding. In addition to those investments, 71 businesses, including Tibco, Conversant, Digital River, and BrightRoll, were acquired in the last 12 months.

When 318 of the 1,100 businesses we’re tracking each have some kind of sizable activity within a 12-month period, you can be sure it is for a reason.

While marketing technology still has a long way to go until it becomes prevalent in every type of business, and not just Fortune 500 or high-tech organizations, the sheer level of activity in the space is a good indicator of future value. In fact, the 71 businesses acquired this year have a total valuation of over $21 billion.

Here are the funding lists for the last three months of 2014 (all amounts in millions of dollars):