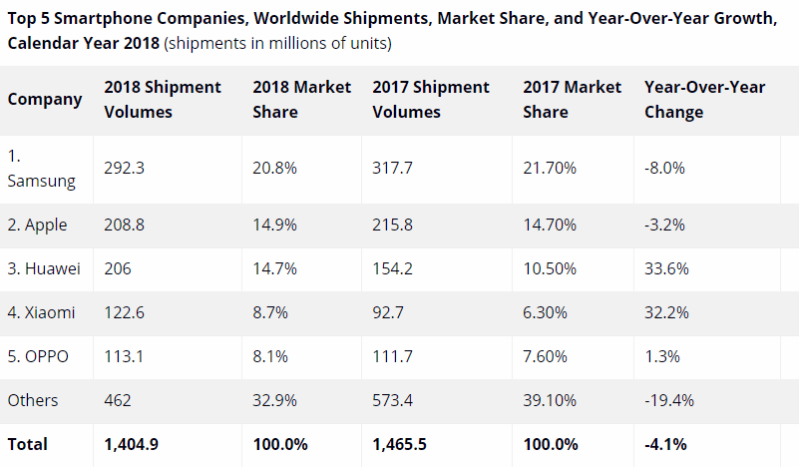

The smartphone market isn’t looking too hot. In a report published today, research firm International Data Corporation (IDC) said that 375.4 million devices shipped to customers during the fourth quarter of 2018, down 4.9 percent from Q4 2017’s peak — marking the fifth consecutive quarter of decline and closing out the worst year ever for smartphone shipments. Global shipments in 2018 dipped 4.1 percent, with a total of 1.4 billion units shipped for the full year.

China experienced the worst of the slump. The country, which accounts for an estimated 30 percent of the world’s smartphone consumption, reported a decline in shipment volume of 10 percent. IDC blames high inventory and an overall decrease in consumer spending.

Samsung — the top smartphone vendor by volume — ended the holiday quarter with 70.4 million total shipments, a 5.5 percent decline from the 74.5 million it shipped globally in Q4 2017. (It drove the Seoul company’s market share below 20 percent to 18.7 percent, and 2018 shipment volume down 8 percent from 317.7 million units to 292.3 million.) Meanwhile, Apple, which ranks second in the world by volume, saw the volume of iPhone shipments dive 11.5 percent, with total volume dipping 3.2 percent to 208.8 million units from 215.8 million for the full year.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

“Globally the smartphone market is a mess right now,” Ryan Reith, program vice president with IDC’s Worldwide Mobile Device Trackers team, said. “Outside of a handful of high-growth markets like India, Indonesia, Korea, and Vietnam, we did not see a lot of positive activity in 2018. We believe several factors are at play here, including lengthening replacement cycles, increasing penetration levels in many large markets, political and economic uncertainty, and growing consumer frustration around continuously rising price points.”

Despite the bad news, a few winners emerged from the wreckage. The top four smartphone brands in China — Huawei, Oppo, Vivo, and Xiaomi — grew their share of the market to 78 percent, up from 66 percent a year prior. Huawei’s shipment volume was up 43.9 percent year-over-year (from 42.1 million units shipped to 60.5 million) and up 33.6 percent for 2018 (154.2 million devices to 206 million), while Oppo saw full-year growth of 1.3 percent to 113.1 million units shipped (from 111.7 million). Xiaomi, not to be outdone, notched a 32.2 percent increase in shipments for 2018, with volume surpassing 100 million (92.7 million units to 122.6 million).

And globally, the top five smartphone companies — that is, Samsung, Apple, Huawei, Oppo, and Xiaomi — consolidated their strength: Their collective shipment volume grew to 69 percent from 63 percent.

IDC’s report follows a similarly gloomy one from Canalys this week. Analysts there estimate that shipments in China last year fell to their lowest level since 2013 — 396 million units — and that fourth-quarter sales alone dropped 15 percent year-on-year. It’s the seventh consecutive quarter of decline, and comes after a 4 percent overall decline in 2017. It mirrored findings from China Academy of Information and Communications Technology (CAICT), a research institute under the country’s Ministry of Industry and Information Technology, which said in January that shipments dipped 15.5 percent to roughly 390 million units for the year, and even more steeply in December.

It’s not all doom and gloom, though. In contrast to China, the Indian market saw extraordinary growth in 2018, with research firm Counterpoint reporting last week that 145.2 million smartphone units shipped in 2018 — a 10 percent year-over-year growth over the 132 million units that shipped in 2017.