testsetset

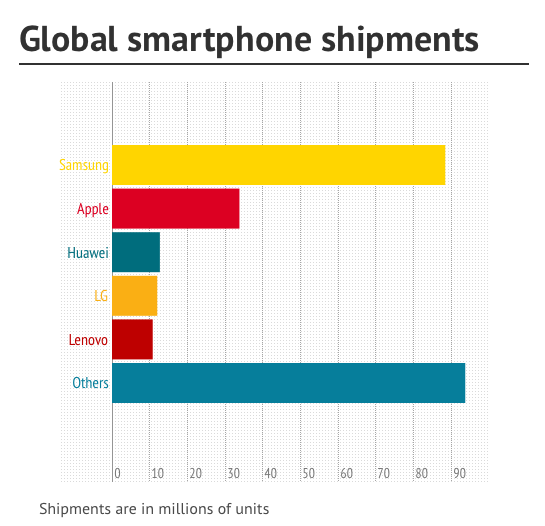

Global smartphone sales passed a quarter of a billion units for the first time ever this past quarter, and Samsung accounted for a staggering 88.4 million of them.

See also: Global phone sales hit 418M as Samsung sells more than Nokia + Apple + LG combined

“Samsung grew 55 percent annually and shipped a record 88.4 million smartphones worldwide, capturing a record 35 percent marketshare in Q3 2013,” Strategy Analytics executive director Neil Mawston said. “Apple grew just 26 percent annually during Q3 2013, which is around half the overall smartphone industry average of 45 percent.”

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Sixty percent of all phones sold worldwide were smartphones, a new high.

While Apple grew slowly, Chinese star Huawei grew even faster than Samsung — though mostly in China, and to a lesser extent in developed markets such as Europe or the U.S.

“Huawei was a star performer as global shipments grew 67 percent annually to 12.7 million units in Q3 2013,” Woody Oh, a senior analyst at Strategy Analytics, said in a statement. “Huawei captured 5 percent marketshare and became the world’s third largest smartphone vendor.”

The single largest share, however, belongs to hundreds of white-label and emerging brand phone manufacturers, who together totaled over 93 million units, indicating that there is plenty of room for regional consolidation in the global smartphone market.

Apple just reported its quarterly earnings, with revenue of $37.5 billion on sales of 33.8 million iPhones and 14.1 million iPads. In addition, the company pulled in record annual revenue of $171 billion for fiscal 2013. However, its growth has slowed significantly as its products have failed to address the low-end and emerging markets as effectively as Android. In China, for example, consumers can get a “Red Rice” smartphone from Xiamomi for just $130, compared to Apple’s iPhone 5C at $549.

Still, there is both hope and growth ahead for Apple, according to Mawston:

“Apple’s global smartphone marketshare has dipped noticeably from 16 percent to 13 percent during the past year. Nonetheless, we expect Apple to rebound sharply and regain share in the upcoming fourth quarter of 2013 due to high demand for its new iPhone 5s model.”