Despite economic slowdowns related to the coronavirus, consumer interest in 5G cellular technology doesn’t appear to have subsided. The latest evidence comes from market research firm Strategy Analytics, which reports that shipments of 5G phones in the first quarter of 2020 alone outstripped all of 2019’s 5G phone shipments, thanks in large part to strong demand from Chinese consumers.

Today’s report is equally important for end users and businesses, as it suggests widespread adoption of the next-generation cellular standard — with its massive speed benefits — is likely to continue regardless of the pandemic. Companies shipped 24.1 million 5G phones during the quarter, nearly 29% more devices than the 18.7 million shipped across all of 2019. Demand was strongest in China, despite significant disruptions wrought by COVID-19 during the quarter. This is thanks to both speedy rollouts of mid-band 5G networks across the country through the end of 2019 and resultant consumer demand for new, faster phones.

Strategy Analytics also noted continued growth of 5G demand in South Korea, the United States, and Europe. 5G tower installations have moved forward in each country despite coronavirus disruptions, as tower climbers have continued to work outdoors to install the new gear, in some cases personally confronting crazy 5G conspiracy theorists in the process. Hospitals, universities, and businesses are beginning to rely on 5G for high-speed teleconferencing and bandwidth-intensive applications.

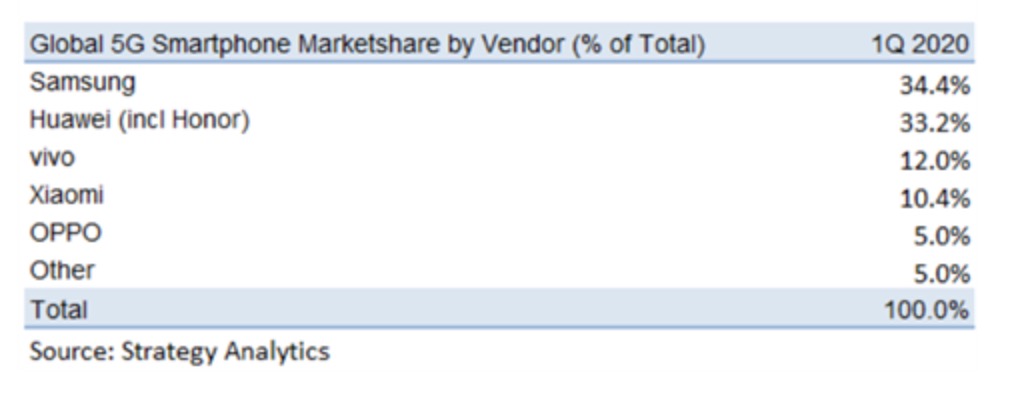

Shipments were certainly helped by Samsung’s release of Galaxy S20 models during the quarter, all of which are 5G-capable, thanks to Qualcomm and Samsung chipsets. The South Korean company led the category by shipping 8.3 million 5G smartphones across the world during the quarter — 34.4% of the world’s total — and it is believed to have seen particular success with the S20 5G and S20 Ultra 5G, its low- and high-end flagship models.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

By comparison, China’s Huawei sold almost all of its 8 million 5G devices in its home country after experiencing security-related difficulties expanding its footprint elsewhere. Huawei leads the Chinese market and is No. 2 globally with a 33.2% share, providing its own chipsets and 5G modems. Three other Chinese vendors — Vivo (12%), Xiaomi (10.4%), and Oppo (5%) — collectively shipped 6.6 million devices, largely based on Qualcomm’s Snapdragon chipsets.

Strategy Analytics expects that 5G shipments will “continue to expand dramatically in 2020,” thanks to demand from China, but didn’t offer further predictions on other territories. The research firm predicted last November that Apple would lead in 5G smartphone shipments in 2020, based entirely on the introduction of the first 5G iPhones in the third quarter, but the pandemic has reportedly put Apple’s production a month behind its normal schedule, potentially deferring its first shipments to the fourth quarter and reducing its total smartphone sales volume for the year.