The much-anticipated “cashless society” is taking longer to arrive than some previously predicted, but it’s clearer than ever that paper and coin transactions are on their way out.

The trajectory of change from cash to digital will, of course, vary from market to market, which is why Uber has announced that it is to begin accepting cash payments for its UberEats food delivery service in some cities, starting with Mumbai in India in the coming weeks.

Uber has been accepting cash through its main taxi app in a number of cities in India since 2015, and the company has since opened up cash payments to many more cities across Asia, the Middle East, and Africa. While most would have expected Uber to limit cash transactions to emerging markets where cash is still popular, the ride-hailing giant opened up cash transactions to the U.K. city of Manchester last year, too.

Cash, it seems, is far from dead — in some places, at least.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

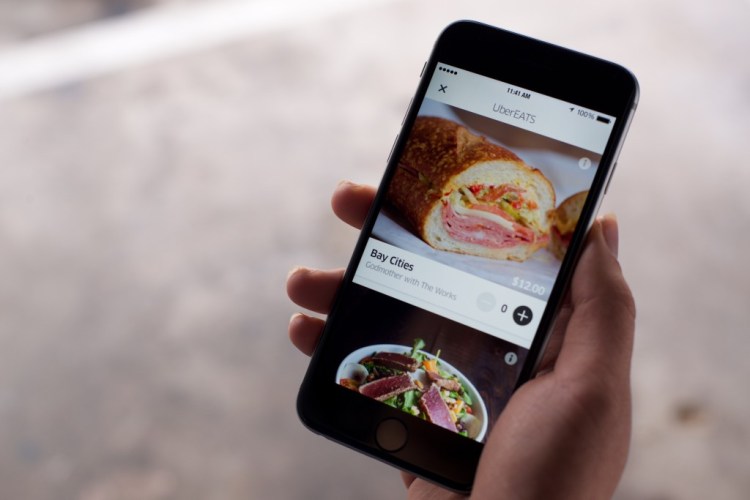

Though Uber continues to face the heat in many cities over its main ride-hailing service, food delivery has emerged as one surprise standout for the San Francisco-based company since it first launched UberFresh in Santa Monica back in 2014 and then rolled out UberEats a year later. If nothing else, it demonstrates what Uber is at its heart — yes, it’s known primarily as an e-taxi service, but it’s really a transport infrastructure company. With its platform, it can turn its hand to anything logistical, such as couriering goods and managing truck freight. UberEats just happens to be one of the services that has taken off, and it’s now challenging other local food delivery services in 30 countries.

That Uber is now accepting cash in Mumbai should perhaps come as little surprise, given that cash is already an option through its main rider app. But it’s also a sign that the company knows it could be onto a winner with UberEats and wants to capitalize on this growth by catering to cash users. The company said that 950 Mumbai restaurants are opening on UberEats every day.

India has emerged as a key focal point for Western tech firms looking to target the “next billion” internet users across the country. Just last week, Google launched a new mobile payments app built for India, called Tez, that’s designed to replace cash transactions. India may have been slower to adopt smartphones and internet usage than other markets, but as of 2016 it had more than 300 million smartphone users. However, cash remains a common method of payment in the region, which is what Google is looking to address with Tez.

“The internet is becoming a daily part of life for many Indians — that includes messaging friends and family, searching the web for information, reading news, watching music videos, or playing games,” noted Caesar Sengupta, vice president of Google’s “next billion users” team, at the time. “But when it comes to paying for things — vegetables, bus fares, splitting the bill at dinner, or paying on delivery for something purchased online — those smartphones often go unused. Out instead comes… wads of paper. Indians love cash.”

And it’s against this backdrop that Uber is now opening up to cash payments in Mumbai, with plans to follow suit in “some of the other 29 countries where UberEats is available today,” according to UberEats product manager Birju Kadakia.

“Just as with Uber rides, we’ve built this feature for India first,” he added. “For Uber riders who use cash, this means you can get a bite as easily as you can get a ride, using the same account for the two apps. For restaurants and delivery partners, cash expands access to UberEats, allowing Mumbai’s food-makers to grow their businesses and reach more of their customers.”