Snap made a small batch of advertising announcements today as part of an effort to let businesses deploy ads more easily and quickly.

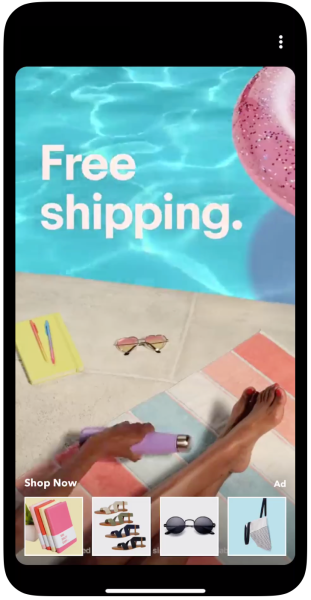

First up: October kicks off the ephemeral camera company’s global rollout of collection ads, which are formatted like product catalogs to feature up to four products. It’s been testing the format since June with companies like eBay, Guess, and Wish.com.

Above: Snap collection ads

Snap said these retailers have seen anywhere from 4.1 to 17 times higher engagement rates using the collection ads format than when pushing individual Snap ads with these products. Competitor Instagram rolled out a similar product-catalog style ad format to advertisers globally in July.

The company also announced today that advertisers can now import their existing product feeds — files containing information like product images, price, and color — to Snap’s Ad Manager. Additionally, Snap is adding more advanced targeting features for Snap Pixel, a conversion-tracking tool it rolled out in November. Through Snap Pixel, advertisers can now create custom audience lists to target audience based upon who visits certain sections of their sites, like shoes or kitchen ware.

June 5th: The AI Audit in NYC

Join us next week in NYC to engage with top executive leaders, delving into strategies for auditing AI models to ensure fairness, optimal performance, and ethical compliance across diverse organizations. Secure your attendance for this exclusive invite-only event.

Last May, Snap began rolling out a self-serving ads manager. That means advertisers can buy Snap ads more quickly, but because these are deployed programmatically, they also cost less. Approximately 75 percent of Snap’s advertising was sold programmatically in Q2 2018, compared to 17 percent in Q2 2018.

Market research company eMarketer released a U.S digital ad forecast this week predicting that Snap will generate about $666.2 million in net U.S. ad revenue this year. That would be an 18.7 percent increase over last year. However, that’s a deceleration from last year, when Snap’s U.S. ad revenue jumped 85.6 percent compared to 2016.

“We believe Snap’s transition to programmatic was the right move, since it makes it easier for advertisers to buy ads,” eMarketer principal analyst Debra Aho Williamson wrote. “But Snap also needs to restore user engagement.”

eMarketer expects Snap to control 0.6 percent of the U.S. digital ad market by the end of the year — the same share it had last year.